Written by: TechAnonymous

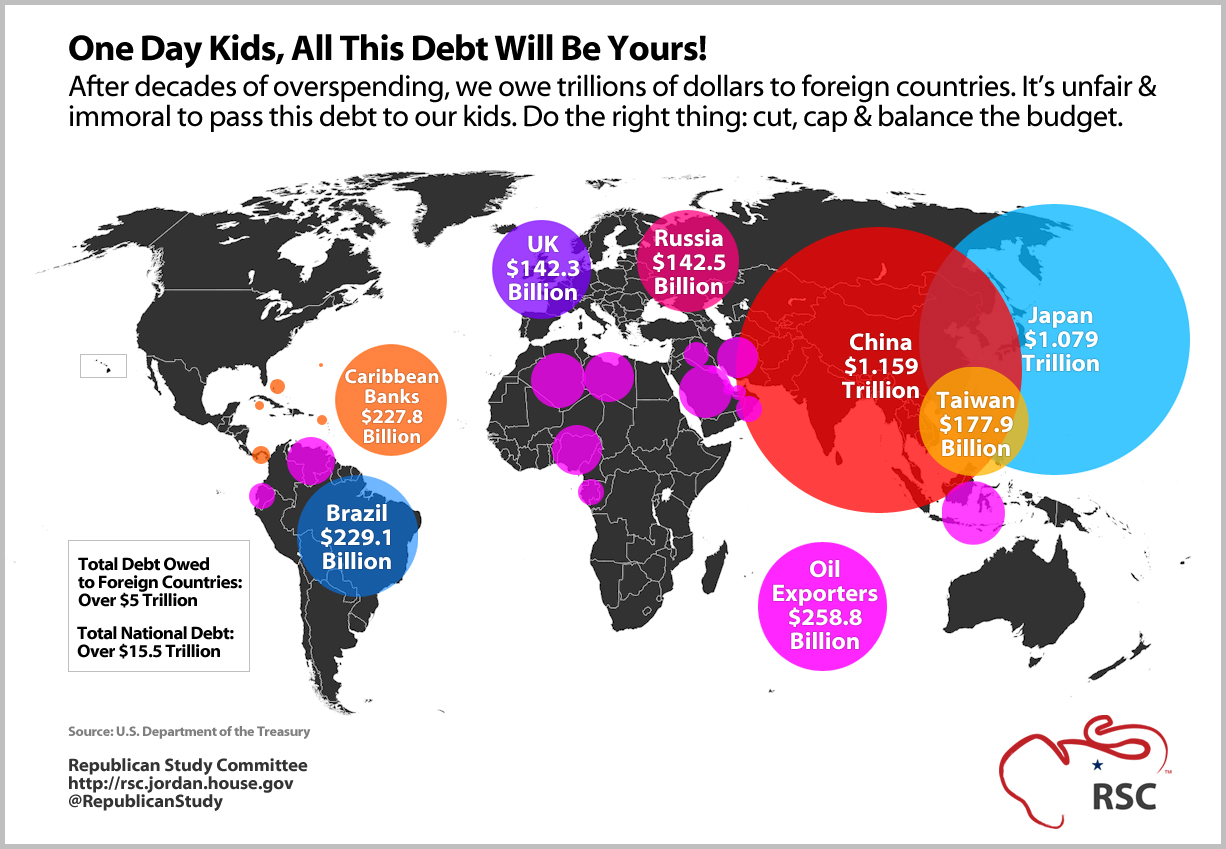

17.9 Trillion dollars… Trillion. That is the US national debt right now. The “unfunded liabilities”, are somewhere around 250 trillion*** (being vague of course) Got that? It seems to be a bit more than a pocket full of shells. How exactly do you wrap your mind around a number like that? You can try just writing it down. It looks like this: $17,900,000,000,000. It still doesn’t seem real. (Click to enlarge the picture below)

US Debt To Foreign Countries

“I was finally able to get a new car for $28,000 and it’ll only take me 6 years to pay that off”.

Bravo! for being able to get that car and being able to put that arithmetic into perspective! You are definitely ahead of the curve in some cases!

“I bought a small house in Illinois for $158,000 and I’ll be able to pay that off in 25 years”

In a world where the rich are getting richer, the poor worse off and the middle class disappearing? You rock! Keep up the great work!

How about that 18 trillion though? All kidding aside, we know there are people out there who have the prowess to understand these high end numbers that seem to come from an old science fiction movie because they work with them every day. Unfortunately there’s just as many people who rely on fingers plus toes equals 20 (men, if you’re creative you can get to 21). How do you even attempt to break down or compare something like this so that anyone and everyone can understand the gruesome reality of it?

According to “Notes for Apres la Guerre Part 2: Banking and Financial Market Theory”

How do we define the sizes of economies? In dollars? Nope. These systems should be measured in terms of a transcendent, invariant unit. Currencies are, by definition, variant, because they are constantly changing relative to one another. This includes the dollar, which is itself measured against a BASKET of other currencies. I propose that GDP should be measured in the unit of MAN HOURS or MAN YEARS. $20 per hour average wage. 2000 hour average work year. Because the buying power of an average man hour or man year shouldn’t change much at all. Think about it.

So, if we take the latest bee-ess GDP for the former US of $16.8 trillion, and if we use an average wage of $20 per hour, or $40,000 per year, we get an economy of 840 billion man hours, or 420 million man years.

Puts a different spin on it, huh? Now, you really want your mind blown? Now do it with the unfunded liabilities of the FEDGOV (conservatively $250 trillion).

450 million man years, and 6.25 billion man years respectively.”

Ok, who understands “man hours” or “man years”? That’s what I thought.

That helps it all make sense now doesn’t it? If all that did was perplex you even more, hit the old reset button on your mind and let’s try to get this into some sort of perspective everyone can grab hold of. Let’s just hang with the $18 trillion dollar debt. Pretty much everyone out there in internet-land is familiar with New York City. The city that never sleeps, The Big Apple etc… According to labor stats* (To make things a little easier, we’ll round off the numbers) there are a little more than 3,500,000 that work full time in NYC every day. The average median income is approx. $63,000 a year. SO! In one year (before taxes) those people will make a little more than 220 Billion dollars. So far, so good.

The average working life of one person is say… 50 years. So long as the number of working folk stays the same (due to new workers and retirees rotating through) We can do some “not so fancy” math and figure out that if every single worker would give every single dollar toward the debt, (drum roll please) your GREAT grandchildren would still have about 7 trillion dollars left to pay! If the train stayed on the track? THEIR great grandchildren might actually see a zero balance! It would only take about 7 generations of all of their families by very rough calculations. If you and the family want to eat and have a room to live in, it may take slightly longer. It’s definitely not an appealing idea is it?

Let’s have ourselves a silly comparison now. Some sources claim that the stack of money required to pay the 18 trillion would be as high as a skyscraper. How many people have actually seen one in person though? According to map software, the distance between NYC and San Francisco is about 2900 miles. A $100 bill is 6 inches long. If lay out $100 bills end to end from NYC to San Francisco you would have $3,026,400,000 (3 billion plus dollars). If you used packs of 100 instead of single bills? You would have a little over 3 trillion dollars laying on the roads. (which is probably the closest any of this money would ever get to the roads). Finally, if we lay 5 more lines of these $100 bill packs alongside the first? We now have a 15 inch wide strip of money a half an inch thick running from one coast to the other just to pay of our basic debt.

Let’s go one more comparison. A football field… Even if you cannot stand American football, you still probably know how big a football field is right? I’m referring to just the field, not the end zones. 100 yards (91 meter) long, 53.3 yards (49 meter) wide. If we covered the field with stacks of $100 bills from side to side and end to end the stack of hundred dollar bills would be a little taller than the average two story house. Are you angry yet? Make sure to call your local politicians and thank them.

__________________________________________________________________________________________

Sources:

*http://labor.ny.gov/stats/nyc/index.shtm

**http://www.newdestinyhousing.org/get-help/area-median-income-ami-chart

The question I find obvious…. Is who is the debt to?!

Can’t the reserve bank (or federal reserve, or whatever…) just print more money?

when that happens the value of the Dollar would go down

However..It’s not worth anything, It’s Legal Tender…

“Federal Reserve notes are not redeemable in gold, silver or any other commodity, and receive no backing by anything. Redeemable notes into gold ended in 1933 and silver in 1968. The notes have no value for themselves, but for what they will buy. In another sense, because they are legal tender, Federal Reserve notes are “backed” by all the goods and services in the economy.”

((((The notes have no value for themselves,))))

It’s funny how you can be in so much debt…when it’s worth nothing… isn’t it?

thats pretty much what germany did right before world war two.

Not sure if you saw the historical photos of German people wheeling full wheelbarrows to the grocery store to by food.

15 Trillion of that debt is owed to the Federal Reserve – which despite it’s name is not a government entity; it is privately owned.

The Federal Reserve is owned by 13 private families not by the government. The more money we print the less its worth and seeing as the government gets its money from the private families america will always owe money because of the companies that those families own to make more money

The federal reserve is who the US is in debt too.. the fed is a private bank, owned by a hand full of private families like all central banks in the world, the banks dont let governments print money, a common misconception by most americans – they think the fed is a government bank, its as government ran as federal express, all the 17 trillion is owed to private familes such as rockerfeller and rothschilds

Your math is all fucked up. You only used New York City to pay off the entire debt which makes no sense at all considering they would pay it off by the end of their great grandchildrens’ generation without any help from the other hundred and fifty million working Americans. Not to mention your example to pay off the entire debt 220 Billion multiplied by 50 years is 11 trillion. which leaves 7 trillion after 50 years. Not sure how you conclude that great grandchildren would already be working and paying that off, its only grandchildren. So the question is: Are you educated in a math or science field at all or simply trying to obscure the facts toward some bullshit idiot agenda? People who read and believe this shit are fucking retarded. Just as blind as the faux news crew.

The perpetual mathematical formulas to figure out exact results for the entire rotating, employed population of the USA to pay off this debt; a)would be too long for the average person to CARE about b) would be too involved for many to understand. The idea is to treat EVERYONE to an equal and basic understanding of what we are in to as a nation. NOT for a whining “wanna be” number cruncher who apparently cannot understand the basic concepts laid out to complain about. Should you happen to know any 10 or 12 year old children, I could politely suggest you let them read the writeup and explain the concepts to you.

Have a nice weekend!

So.. You’re saying his rough, bare minimum math to put it into perspective wasn’t good enough for you? And that U.S. citizens would want to help pay off the debt?

Even the U.S. government doesn’t want to do that..

What are you, a disinformation specialist?

tend to think blaming obama is incorrect; he is merely one prince among many powerful barons and earls. put another way, one man’s mind cannot overcome the inertia of [ say ] 1000 wrong-thinking generals, secretaries, heads of department and so forth

I am not sure why New York would be the only people paying it off… so that It doesn’t make any sense at all and skews the entire article….

But it is bad.

Assuming the numbers I got are right, if you think a $56K per person debt is bad, if you do the same thing per person with the tax revenue, the average income per person is about $9,500 per year.

So, if the US was a person, the income would be $9,500 per year, with a debt of $56,000.

I am sure that if you added up the costs the US has, I am fairly certain it would cost more than $9,500 per person to run the place before the debt repayments are started.

While only New York was used to calculate the speeds for paying off the debt, he also assumed that these New Yorkers payed every penny they made in to taxes solely to pay off the debt. While a significantly larger number of people will be realistically paying in money, they will all be paying in a lot less. Honestly I’d be willing to bet that if we did the real math using everybody in the country and a realistic tax rate we’d find that these numbers aren’t too far off in the realm of rough estimates, but again the author made it very clear that he was running some very rough numbers and calculations.

what I want to know is why you go on about the rothschilds and how they control the world which we know is true not to mention the rocket fellas gold ergs etc yet your advert on your page (moneyweek ) is owned by a Rothschild ?? Conflicting interest??

How long to pay OF or how long to pay OFF???? Do you need an editor?

-Audrey