Tax loopholes that had been a boon for multinational corporations have been ruled illegal by the European Commission.

This means that corporations can no longer claim to be based in a country with lower tax rates, thus skipping out on paying higher taxes in European countries where their income was originally earned.

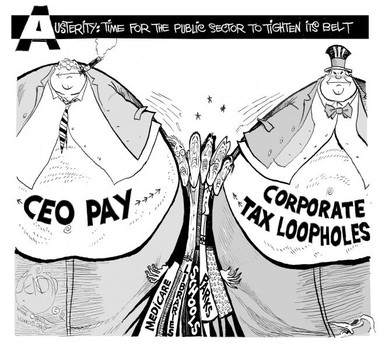

This change seems to have been brought about thanks to the campaigning of UK Uncut, an anti-austerity movement which had linked corporate tax avoidance with cuts in public service; austerity for the people, tax avoidance for the corporates.

The commission has also ruled that Starbucks and Fiat in particular must pay back some 34 million USD they had “saved” by abusing tax loopholes in Luxembourg and the Netherlands, with more potential implications for the companies incoming.

“The Commission continues to pursue its inquiry into tax rulings practices in all EU Member States,” the commission statement read. “Its existing formal investigations into tax rulings in Belgium, Ireland and Luxembourg are ongoing.”

Corporations have long been able to avoid paying the full sum of taxes due to their host nations by simply booking profits earned in high-tax nations like the US as profits earned in bank accounts located in low-tax nations such as Ireland.

The commission explains the process in relation to Fiat and Starbucks:

The two tax rulings under investigation endorsed artificial and complex methods to establish taxable profits for the companies. They do not reflect economic reality. This is done, in particular, by setting prices for goods and services sold between companies of the Fiat and Starbucks groups (so-called “transfer prices”) that do not correspond to market conditions. As a result, most of the profits of Starbucks’ coffee roasting company are shifted abroad, where they are also not taxed, and Fiat’s financing company only paid taxes on underestimated profits.

“Tax rulings that artificially reduce a company’s tax burden are not in line with EU state aid rules. They are illegal,” said Margrethe Vestager, the EU Competition Commissioner.

Although the scope of the investigation is restricted to only Europe at this time, American corporations may soon be called to account for the taxes that they owe the US.

Apple and Amazon are notorious for having skimped on their American taxes by using Ireland’s and Luxembourg’s tax laws respectively.

Sources: US Uncut

This Article (European Commission: Corporate Tax Loopholes Are Illegal) is free and open source. You have permission to republish this article under a Creative Commons license with attribution to the author(CoNN) and AnonHQ.com.

There are far too much taxes in this country (UK) Why should one work hard expand a business or a company for others to sit and breed for nothing! I am all for tax avoidance schemes as it levels the playing field. High earners that have avoided income tax and capital gains tax still put far more taxes into the system by a range of other taxes such as vat, stamp duty, inheritance tax and so forth. There has been times my accountants charged me more than the vast amount of tax i have avoided, but still continue to avoid taxes. Cut taxes to a uniformed 10%! 10% income tax 10% capital gains tax 10% corporate tax and all tax avoiding will seize immediately and collectively the state coffers will receive more tax overall!

‘Cease’ not ‘seize’. Your grasp of English is as bad as your attitude!

They are robbing the country that makes them wealthy. If they want to take our money in sales then they should pay our taxes like the ordinary man in the street. If they dont like it then set up business in a country with lower tax rates

Why the heck should starbucks pay back? The state itself needs to start paying back its debt. This is just another way for the gov to take even more control.