The Trans-Pacific Partnership (TPP) is a proposed trade agreement between several Pacific Rim countries concerning a variety of matters of economic policy. Among other things, the TPP seeks to lower trade barriers such as tariffs, establish a common framework for intellectual property, enforce standards for labour law and environmental law, and establish an investor-state dispute settlement mechanism. (wiki)

Recently an important section of the TPP was leaked. The contents of the section were kept secret from the public…for reasons you would not be happy to hear.

The section of the TPP that has leaked is the “Investment” chapter that includes investor-state dispute settlement (ISDS) clauses. WikiLeaks has the text and analysis, and the Times has the story, in “Trans-Pacific Partnership Seen as Door for Foreign Suits Against U.S.“:

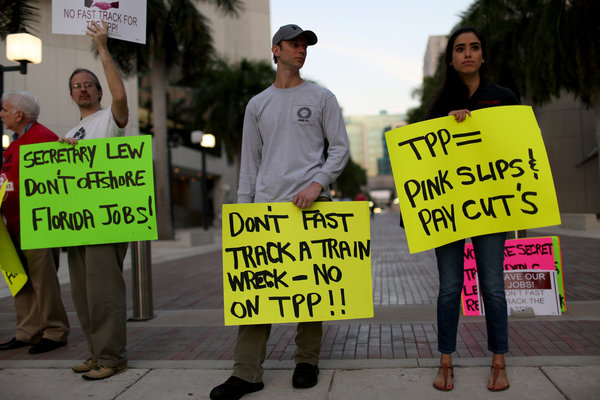

“An ambitious 12-nation trade accord pushed by President Obama would allow foreign corporations to sue the United States government for actions that undermine their investment “expectations” and hurt their business, according to a classified document.

The Trans-Pacific Partnership — a cornerstone of Mr. Obama’s remaining economic agenda — would grant broad powers to multinational companies operating in North America, South America and Asia. Under the accord, still under negotiation but nearing completion, companies and investors would be empowered to challenge regulations, rules, government actions and court rulings — federal, state or local — before tribunals organized under the World Bank or the United Nations.”

The WikiLeaks analysis explains that this lets firms “sue” governments to obtain taxpayer compensation for loss of “expected future profits.”

Take a moment to make sense of what it actually means: “[C]ompanies and investors would be empowered to challenge regulations, rules, government actions and court rulings — federal, state or local — before tribunals….” And they can collect not just for lost property or seized assets; they can collect if laws or regulations interfere with these giant companies’ ability to collect what they claim are “expected future profits.”

The Times‘ report explains that this clause also “giv[es] greater priority to protecting corporate interests than promoting free trade and competition that benefits consumers.”

Because of this arrangement, foreign companies will have an advantage.

Global Trade Watch explains this advantage:

The TPP would grant foreign investors and firms operating here expansive new substantive and procedural rights and privileges not available to U.S. firms under U.S. law, allowing foreign firms to demand compensation for the costs of complying with U.S. policies, court orders and government actions that apply equally to domestic and foreign firms. … The text allows foreign investors to demand compensation for claims of “indirect expropriation” that apply to much wider categories of property than those to which similar rights apply in U.S. law.

“The TPP has developed in secret an unaccountable supranational court for multinationals to sue states. This system is a challenge to parliamentary and judicial sovereignty. Similar tribunals have already been shown to chill the adoption of sane environmental protection, public health and public transport policies.” says Julian Assange of Wiki Leaks

Get Your Anonymous T-Shirt / Sweatshirt / Hoodie / Tanktop, Smartphone or Tablet Cover or Mug In Our Spreadshirt Shop! Click Here

This Article (Now We Know Why Huge TPP Trade Deal Is Kept Secret From The Public) is free and open source. You have permission to republish this article under a Creative Commons license with attribution to the author and AnonHQ.com..

So why does your website often have pop ups to a game you must be 18 years of age or older to play? What does that have to do with real news?

I have get any kind of pop ups. maybe your computer is infected?

ASOLUTELY! Americans should be afraid, not all the countries BUT the USA. Fucking idiots. May i remember you who is greatest in sueing the shit out of others? Riiiiight, america. So who is going to sue who? Right, america, everyone. We europeans are really afraid of that crap because we know we will pay for american companies some day.

TPP, TTIP & other Global Treaties/’Arrangements’ Have to be Secret.

There are several reasons for the secrecy (“omerta”) of the dispute resolution tribunals. They are:

1) To Protect the parties to the treaty, &/or, agreement, ie. corporate sponsors, from having to reveal to the non-shareholding tax payers the existing arrangements that it has with its own government. For instance, the Canadian W.A.D. Accord suggests that corporate Canada’s lobbyists pay considerations to the executives of the political parties for two main reasons:

A) to promote corporate Canada’s agenda with governing party(ies) by:

i) reducing its taxes & thus, the “net increase” in taxes for non-shareholders

&

ii) increase its funding for “economic development” which covers

the cost of, among other things, the present & future advocacy,

ie. lobbying & the cost of the considerations that corporate

Canada pays out, etc. It may be regrettable that given the source

of the accessed “economic development” funds, ie. those

95% – 99% of Canadians who are non-shareholding tax payers

there is a great deal of room for discretionary spending & its

abuse

and

B) to protect corporate Canada’s agenda by paying the other (non-governing) political parties considerations in order to limit the scope of the “opposition” to manageable issues that can be compromised in order that “opposing” parties can claim victories (at least a limited victory) for their constituents. Under this

arrangement both, the politicians & the lobbyists’ clients are protected from scrutiny by the role of the parties’ executives.

2) To Protect the parties to the treaty, &/or, agreement, ie. corporate sponsor from having to reveal to the each others’ corporate sponsors their existing arrangements that it has with its own government &

thus,

each counties’ corporate sponsors are not obliged to share the benefits & considerations (& future considerations) that they receive from their respective governments ie. their non-shareholding taxpayers. Often the benefits are shared as an inducement to conduct business together in the more convenient jurisdictions.

3) To Protect the parties to one treaty, &/or, agreement (referred to as the “original” treaty/agreement) from having to reveal to third parties the nature, &/or, details of their “original” arrangements to other third parties who may want to enter into a treaty, &/or, agreement with either of the parties to the “original”

agreement/treaty.That is to say, that acquiring & having privileged information of an outsiders treaties, &/or,

agreements will cause contention as the third party will undoubtedly insist upon more favorable terms & conditions to a new treaty/agreement than the original treaty/agreement. For example;

“You did this with them, so I insist upon more, or, I’ll deal with them, or, others”.

The European Union is particularly interested in preventing the Canada – European Union CETA from becoming divisive whereby individual EU member countries may be enticed, &/or, coerced into making preferential, but, “very secretive” side deals with corporate Canada, et al, by preventing the non-shareholding taxpayers from learning about the aforementioned reasons for the tribunals’ secrecy whereby the non-shareholding taxpayers pay for the increase in the value of the shareholders’ stocks & dividends is insider trading & stock manipulation.

Therefore, corporate Canada, AFN & their traditional media outlets have more than just a vested interest in the continuation of the most vulnerable Canadians (95% – 99% of Native & non Native Canadians) deprivation of the information such as the comprehensive version of The W.A.D. Accord and the comprehensive versions of the Canada – China Investment Treaty, the Canada – European Union CET Agreement, et al, that include the mechanisms, procedures, practices used in the adjudications of the dispute resolution tribunal & its disbursement of its punitive awards.

And, while it may be regrettable that not all of the 95% – 99% most vulnerable, non-shareholders are able, &/or, willing to move to a sovereign Quebec, or, other jurisdictions, in order to:

1) avoid the “unethical” & “inhumane” (see; The W.A.D. Accord), but, “legal” practices

and

2) start getting the relevant & quantitative information regarding

the above, et al.

The issue of the secret tribunals raises some interesting questions that the “secret congress” of the lobbyists’ clients & the executives of the political parties have no intention of answering.

For instance; what do the above arrangements say about the 95% – 99% of Canadians who are non-shareholding tax payers & the version of “democracy” that they are developing in Canada in the context of the growing “global” economy

and

what do the above arrangements say about the accelerating growth of the disparity of the wealth between the shareholders (1% – 5% of Canadians, et al) & the non-shareholders (95% – 99% of Canadians), et al?

What are you, the reader, learning about the Canada – China Investment Treaty that will help you to ascertain whether the Canada – European Union Agreement is better for you & perhaps, corporate Canada?

What are some of the other questions that the non-shareholders need to ask

&

who can answer, &/or, is willing to answer (as opposed to “respond’ to) their questions that would make them willing participants & direct beneficiaries of the TPP, the C-CIT & the CETA?

Have you & your family, friends & colleagues sent PM Harper & Mr. DAN HILTON (Executive Director of the Conservative Party) your:

“NOTIFICATION of Preexisting CHALLENGE to the TRANS PACIFIC PARTNERSHIP”,

“NOTIFICATION of Preexisting CHALLENGE to the CANADA – CHINA INVESTMENT TREATY”

and

“NOTIFICATION of Preexisting CHALLENGE to the CANADA – EUROPEAN UNION COMPREHENSIVE ECONOMIC & TRADE AGREEMENT”,

in order to enhance your opportunity to exculpate yourself from having to pay for:

1) the aforementioned Compensation that is embodied in The W.A.D. Accord

&

2) the costs, penalties, punitive damages that will be derived from the TPP, C-CITreaty & the CETAgreement?

In conclusion, it may be regrettable that the TPP, the C-CITreaty & the CETAgreement has, so far, been successful at giving corporate Canada

&

its representatives the much higher degree of legitimacy to their aforementioned secrecy (assisted by way of the international cache) that it needs in order for them to later, & once again, claim (see; NAFTA) that they are doing/did “their best” to protect the non-shareholders from the over zealousness of their foreign Treaty, &/or, Agreement counterparts.

Is it not easier & just prudent to discuss the preexisting arrangements & challenges to the Treaty & the Agreement prior to ratifying them in order to determine which is more egregious than the other (or, are both equally egregious) & thus, avoid any of the secret “dispute” resolutions & its “hefty” costs to the beleaguered non shareholding taxpayers, et al? And, how much more will these costs further erode the non-shareholding taxpayers health care (privatize), educational services, etc.?

How much has corporate Canada set aside to defend the CHALLENGES, et al, that corporate Canada & the non-shareholders, et al, are anticipating?

How far along are they in collecting this fund & how much more does corporate Canada & its shareholders need to set aside before the non-shareholding taxpayers allow corporate Canada & its representatives to proceed?

Similarly, due to a psychiatrist’s previous linking of the deprivation of information with the unconscionably high rates of despair, disenchantment, suicides, unemployment, poverty, etc., that are found in many communities across Canada, what are the various different ways that non shareholders can guarantee that corporate Canada & its shareholders have enough financial reserves set aside in order to pay for the CHALLENGES by the non-shareholders and those who will be the new victims of the aforementioned deprivation of information?

On the other hand, are there actually any non shareholding taxpayers who think that corporate Canada is actually anxious to explain to them, or, corporate China, or, corporate EU, just how effective their secretive relationship between:

1) lobbyists’ of corporate Canada

&

2) the executives of the parties that are operating in Canada, has

been & is continuing to be?

And, finally, without:

1) a meaningful forum in which to “further question” the Treaty

& Agreement without the fear of recriminations, etc.,

2) a predetermined list of circumstances whereby corporate Canada can terminate the Treaty & the Agreement without penalties, &/or, costs to the harmless non shareholding taxpayers

&

3) et al,

the ratification of the TPP, the C-CITreaty & the CETAgreement will eliminate for most Canadians the last remnants of “democratically” effecting the treaty/agreement by the non-shareholding taxpayers

&

thus, corporate Canada, et al, will finally be able to give these arrangements the luster of legitimacy that they need that is based upon the logic that

“It can’t be another gilded cage that will cause another economic melt down like the “derivative type conspiracy”**that is continuing to debilitate international finance, etc., because there are just too many vanguards of industry promoting the public financing of the TPP, the C-CITreaty & CETAgreement”.

The secrecy of the TPP, the C-CITreaty & CETAgreement arrangements are not dissimilar to insider trading, whereby the shareholders who are on “the inside” use secret, &/or, privileged information to make money for themselves at the expense of the group that is on the “outside”, the non-shareholding taxpayers, who are being deprived of the aforementioned information & thus, are being deprived of the opportunity to enjoy the direct benefits of the treaty/agreement. And, just as some of the means to counter these arrangements are also not dissimilar to those counter measures that can remedy insider trading & pay punitive damages, etc. to the harmless non shareholders. And, while it is likely that the “coveted” Chinese investor*** may have enough of the insider information regarding the more “unethical”, &/or, “inhumane” arrangements in the C-CITreaty to navigate the mechanisms of the secret dispute resolution tribunal in his favor & at the peril of corporate Canada, it may be regrettable that it is highly unlikely that the European Union has been as fortunate regarding the CETA arrangements. This disparity between China’s benefits from the C-CITreaty & the benefits that the EU may derive from their CETA will continue to be dangerously contentious.

And, finally, it may also be regrettable that there is yet another vulnerability that corporate Canada, especially its Alberta chapter, is particularly desperate to be kept secret for as long as possible

and

it only remains to be seen when it will be most advantageous to “leak” the secret & by which party.

***

FULL Article, see; ‘Inside Trading…’

at davidehsmith.wordpress.com

* The W.A.D. Accord; Reference:

For those who may not be familiar with The WAD Accord, &/or, its recent developments, The Accord can be accessed on line by way of the submission entitled:

“Towards a More Informed Opinion regarding the Environmental Impact & Context of the NGP (Pipeline), et al”, Researched & Submitted by D.E.H.S., July 24, 2012 to the Enbridge Co.’s NGP Joint Review Panel..

Contact:

Ms. Colette Spagnuolo,

Process Advisor, Northern Gateway Project

(22nd Floor, 160 Elgin St. Ottawa ON K1A 0H3),

Or,

Google

For the other information that may lead the non-shareholders, corporate China and corporate European Union & their shareholders & the non-shareholders, et al, to a greater certainty regarding what corporate Canada may be sharing with you regarding the accessing of the aforementioned, information & Canadian natural resources, et al, I can be contacted at:

see; Facebook;

“David E.H. Smith, Sidney, BC.

Non shareholders & the other potential participants in the TPP, the

C-CITreaty & CETAgreement can access more of the relevant articles that have been researched & posted on Facebook (& several online newspapers, et al)

at:

davidehsmith.wordpress.com

to access the List of RECENT ARTICLES, LETTERS & NOTIFICATIONS by DEHS.

**”derivative type conspiracy”; “The $58 Trillion Elephant in the Room” by Jesse Eisinger. Upstart Business Journal, October 15, 2008, 8:00am EDT. Re; the “industrialized credit derivatives”

***the “coveted” Chinese investor;

Who is the “coveted” Chinese investor who said:

“It’s not that we are racist when we are dealing with Canadians,

it’s just that we can’t stand the way that you suck up to us.”?

*********