IPO access, or Initial Public Offerings, is a brilliant approach for those in congress to accept financial incentive without risk of imprisonment. One example used is if a person walked into a Senator’s office with a shoebox of money and wanted a favor in return, both are going to jail. If the same person came in with a pre-IPO that would make the senator $100,000 in one day – special access to purchase stock before it becomes available to the public, it is perfectly legal, says Peter Schweizer, author of Extortion.

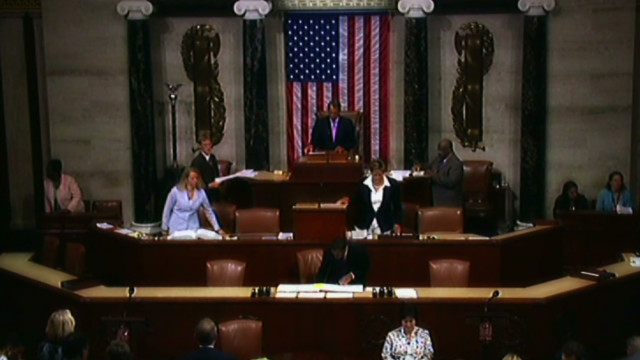

Rep. Nancy Pelosi was one such congress woman with insider trading knowledge. In 2008 March 18, she got special access to purchase VISA stock the day before it was released to the public. Her trades totaled between 1 and 5 million dollars as VISA stock value jumped by 50 percent in two days. The timing of the IPO access coincided with house legislation VISA strongly opposed. Pelosi, at the time, ensured the legislation never made it to the floor for a vote.

Less than 2 weeks before the 2008 economic collapse – one of the largest crashes witnessed on Wall Street – 10 senators received insider trading tips that saw them pull their money from the stock market. The impending market crash was well known, with secret meetings held between the Treasury Department, the Federal Reserve and the high ranking officials.

‘For the Record’: How Congress Cashes In On The Stock Market from TheBlaze Videos on Vimeo.

Years following the market collapse, 60 minutes aired an investigation exposing the loophole that gave ‘extraordinary access,’ to information that the public are kept from. Schweizer told Steve Kroft that “It’s really the way the rules have been defined. And the people who make the rules are the political class in Washington and they’ve conveniently written them in such a way that they don’t apply to themselves.”

Since the expose, the Stock Act has been passed. However, the Act, which intended to hold members of government to the same level as the public in the event of insider trading, the Act has since been watered down by officials. It seems, at the end of the day there are two sets of rules – one set for our lawmakers, and one set for everyone else.

This Article (Congress: Insider Trading Deals done days before ’08 Crash ) is a free and open source. You have permission to republish this article under a Creative Commons license with attribution to the author AnonWatcher and AnonHQ.com.