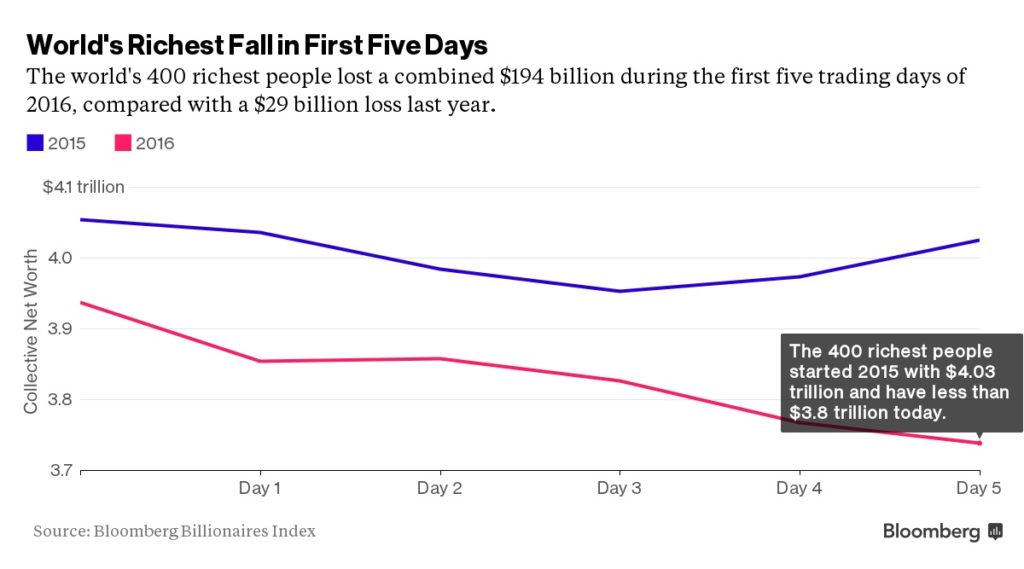

Those who follow Wall Street and the stock markets closely would have noticed the epic fall of the top 400’s richest people. In the first week of January, the world’s richest people lost almost a staggering combined fortune of $194 billion and since the beginning of the month until now a total of $350 billion. The blame was largely rested upon China’s shoulders with their economic decline and the low oil prices.

In the first trading week. Amazon.com founder Jeff Bezos lost the most, watching his fortune drop off by $5.9 billion, while Bill Gates witnessed his wealth take a dive in profits by $4.5 billion. The combined losses of $3.7 trillion this week have equated closely to Germany’s GDP.

And since the beginning of January 2016, Bezos lost a total of $10.8 billion followed by Bill Gates’ loss of $6.8 billion.

But what happens to the money lost? Where does it go? It’s an age old question that never seems to find an answer.

You can talk about the stock markets in terms and meanings, risks, assets, floating a company, going public with sales, and so forth. Needless to say, Wall Street and his associates are a complex game to anyone outside the loop. The million dollar question (mind the pun): can the markets be manipulated to the whims of government?

Theory One – the Pragmatic Approach

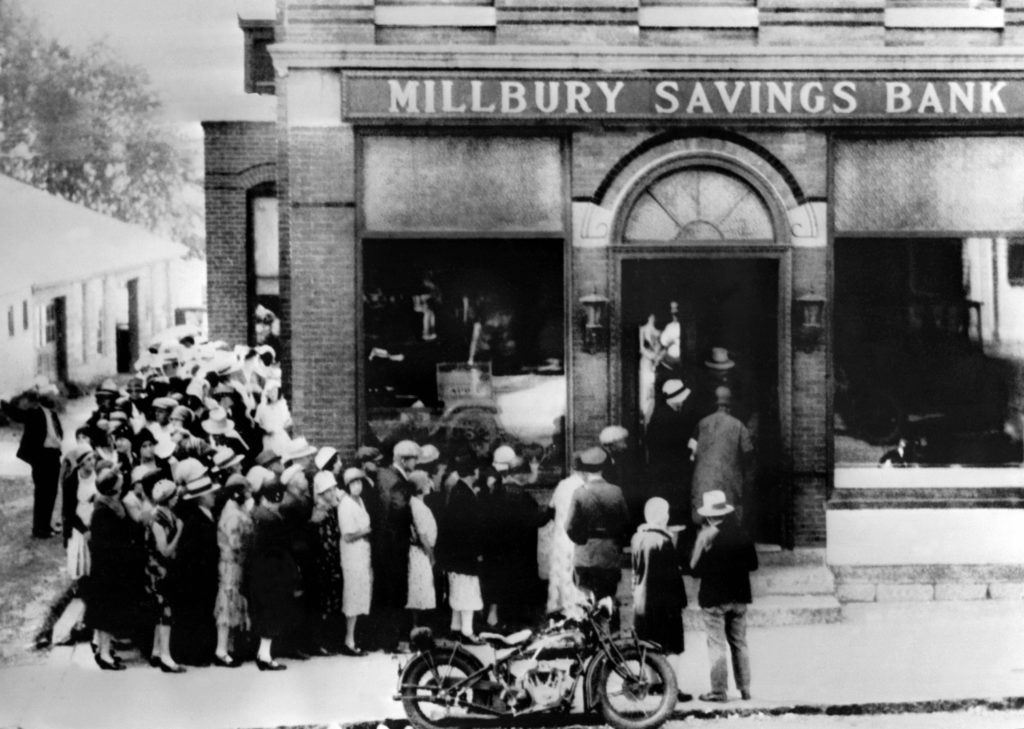

The Crash of 1929 is a prime example of fluctuating markets – mainstream suggests several clear trends that lead to the crash: rampant speculation, booming markets that continued to rise quickly, deals leveraging too much stock without physical backups (the imagined stock); hence the bubble getting too big and bursting.

End result: over $25 billion wiped from the market in one day ($319 billion in today’s dollars).

Theory Two – the Not-So-Pragmatic Approach

The fringe story – central banking forces purposely triggered the collapse so that they could buy up stocks for “pennies on the dollar.” Why? Self-interests and control over the markets. If this is true…who, and why?

Firstly, probability suggests that the Federal Reserve are more inclined to prop markets accordingly to their schedules. If they were considered part of the Treasury and subjected to their rules, the more the better; but they aren’t. The ‘fifth column’ of the government, the Fed, aren’t as independent as some believe. If the Fed were to withdraw from the markets tomorrow, would everything come crashing down?

The ‘What If’ Approach – Hypothetically Speaking…

Money doesn’t just disappear into thin air…or does it?

This week we witnessed 194 billion wiped from the markets. Eight weeks ago the GCC announced contracts expected to reach 194 billion for Middle East infrastructure contracts – a quarter of their total worth. The GCC countries: Kuwait, Bahrain, Oman, Oatar, Saudi Arabia and the UAE have had strong ties with the US since 1933.

The US-GCC relationship endeavors to “build on [the] meeting of minds, pursuing strong strategic relationships with countries throughout the Gulf, as it has helped to develop and increasingly defend the region’s energy resources [predominately oil].” The document further relates to Iraq’s invasion into Kuwait and the Gulf War, September 11 attacks, and…

“2004 forecasts by some geologists and financial advisers that world oil reserves had either already peaked or would soon do so, contributing, along with the chaos and uncertainties associated with the U.S. invasions and occupations of Afghanistan and Iraq, to $60 a barrel.”

But how unlikely the U.S. higher powers would divert funds to their GCC counterparts to secure the invested region’s grasp on a dwindling oil supply. It just wouldn’t happen.

This Article (Buying and selling the intangible idea: Where did $194 billion go?) is a free and open source. You have permission to republish this article under a Creative Commons license with attribution to the author AnonWatcher and AnonHQ.com.

WalMart too is closing 269 stores nationwide, does it have to get any worse before it rebounds and gets better? Something is up and I think all these companies are going to claim losses and have their insurance companies pay them out. Somethings up for sure!

I’m with you on that. How can a huge ass corporation like Walmart trumpet that since their profits are down they need to close stores. Yet they bring in a ton of money from other stores that could easily balance out those other closings.

X walmart employee. They were already doing that the past 10 years to take out local business

Possibly an economic strategy known as ‘creative destruction’? I’m no economist but from what i’ve read this practice results in a company ‘downsizing’ it’s infrastructure and operations to ultimately retain maximum profit going forward. I may have misunderstood the practice and i know i’ve over simplified the theory but ‘creative destruction’ has existed for a long time in business as a means to keep companies streamlined for profit/functionality. On a corporate level the loss of employment is second to profit. Always. That i do know.

The reason those stores are closing is because they were part of what’s called Express Stores. These were opened to streamline the shopping experience for the customer! It didn’t work out for Wal-Mart, so they’re closing them for purely their own economic reasons

Obamacare has something to do with it. The premiums are going so high with rediculous deductibles. I’m 55 year old and forced to pay out $400 a month for health insurance, with a $7,000 deductible. That’s $100 a month. NOW THINK for a second how that impacts spending on goods and services–yes, I cut back a lot. Now multiply that times millions of people. The health care system and pharmaceuticals are ripping us off left and right and our federal government isn’t doing a damn thing about it. So yeah the world economy is crashing. THINK–everything is MADE IN CHINA so people are buying less goods to make payments on expensive UN-affordable health insurance. Further, because I’m 55 years old, I have to pay out a lot more than someone who is like 43 years old. They pay about $250 a month for the same insurance. that’s blatant age discrimination.

CORRECTION I pay out $100 a week. That’s $400 a month. Excuse the typing error.