Part of the growing global economic malaise could be attributed to the Malaysian government investment fund 1MDB (short for 1Malaysia Development Bhd.), which has officially defaulted on a 1.75 billion US dollar bond, when it failed to make a 50 million dollar interest payment. The fund was intended to transform Malaysia’s capital city Kuala Lumpur into a financial hub.

The fund has apparently refused to pay the interest as its co-guarantor for the bonds, Abu Dhabi’s International Petroleum Investment Co. (IPIC), had also reneged on its obligations. Apparently neither side could agree on whom was responsible for the interest payments. IPIC said that it would pay the interest only after 1MDB was declared in default.

The default has led to a sell-off in the Southeast Asian nation’s currency and 1MDB’s dollar bonds.

“Investors are pulling back now and it’s a knee-jerk reaction,” said director at Fortress Capital Asset Management Sdn. in Kuala Lumpur Geoffrey Ng. “It presents a credit risk issue to foreign investors and it causes uncertainty in terms of the outlook for Malaysian government credit ratings.”

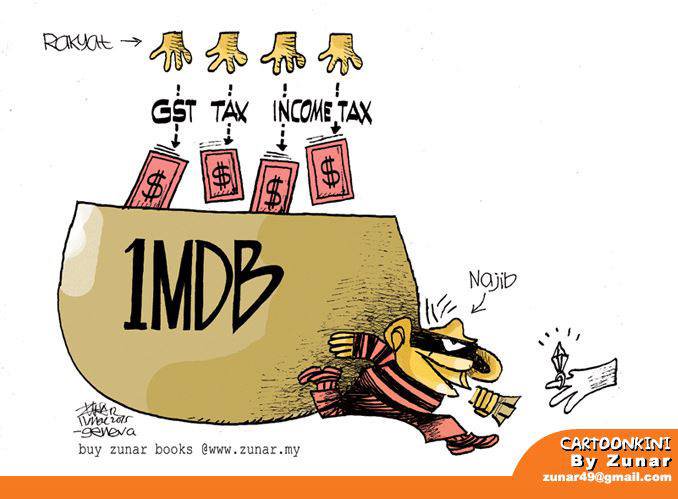

1MDB claims to actually have sufficient funds to make the payment, though the troubled “investment” fund has been put through the ringer for numerous scandals. 1 billion dollars was found in Malaysian prime minister Najib Razak’s personal bank account, with much of it from 1MDB, according to the Wall Street Journal.

(Possibly laundered through a web of intermediaries, though Malaysia’s current attorney general cleared Najib of the charges and claimed that it was merely a Saudi political donation. The previous attorney general had been forced to retire after a special task force he headed raided 1MDB’s offices). Also, up to 4 Billion dollars had been misappropriated from Malaysian state investment companies according to Swiss attorney general Michael Lauber.

Najib refuses to step down, calling protests over the beleaguered fund “haram” and has used nationalistic and racially divisive rhetoric to discredit protests. He also faces a US corruption inquiry over shell companies linked to his stepson.

1MDB’s refusal to pay the interest was apparently a matter of principal.

“Whilst 1MDB has the funds to have made the interest payment, it is 1MDB’s position, as a matter of principle, that it was IPIC’s obligation to do so,” said a 1MDB spokesperson in a statement. “Until IPIC accepts that all obligations have been met, 1MDB is obliged to withhold payments and will seek legal recourse and resolution.”

Zero Hedge notes that Société Générale, a French multinational banking and financial services company, had explored the possibility of a 1MDB default leading to a wider sovereign default.

“If the interest payments under the 2022 Notes are not made on or before April 25, 2016, it would constitute an event of default thereunder, which could result in acceleration of the 2022 Notes and could result in cross-defaults or cross-acceleration of other indebtedness of 1MDB by the relevant creditors.

The total principal amount of such other relevant indebtedness of 1MDB which could become due and payable as a result of the foregoing, and to which the Government is potentially exposed by way of guarantees for such debt is RM5.8 billion [USD1.48bn equiv.].

In addition, the Government is potentially liable for up to U.S.$3.0 billion in principal, plus interest, under its letter of support as set out above [namely the OGIMK 2023s]. If 1MDB were unable to make such payments as they become due, the Government does not believe that any amounts that it would be required to pay with respect to the indebtedness of 1MDB would be material to the Government.”

Sources: Bloomberg, WSJ, Zerohedge, IB Times, CNBC

This article (Malaysian Govt Investment Fund Defaults, Raising Prospect of Sovereign Default) is a free and open source. You have permission to republish this article under a Creative Commons license with attribution to the author(CoNN) and AnonHQ.com.

ITS NOT JUST STEALING FROM THE PEOPLE UNEXPLAINED MURDERS. ARREST, THE PRIME MINISTER IS INVOKING DRACONIAN LAWS TO SILENCE CRITICS.

DECENT IS MEET WITH RETALIATION AND MORE ARREST.

OPPOSITION POLITICIANS ARE CHARGED REPEATEDLY.

THERE IS NO MORE FREEDOM. RACE AND RELIGION IS BEING USED TO DIVIDE THE NATION. THE PRIME MINISTER CLAIMS CLOSE RELATIONS WITH THE NO1 TERRORIST FUNDING NATION IN THE WORLD – SAUDI ARABIA.

THE PRIME MINISTER HAS REPLACED THE ATTORNEY GENERAL, SPECIAL BRANCH HEAD, ANTI CORRUPTION HEAD. DISSOLVED THE TASK FORCE INVESTIGATING THE MISSING BILLIONS. PARLIAMENT PUBLIC ACCOUNTS COMMITTEE (PAC) REPORT WAS A CLEAR INDICATION OF COVER UP.

THE HEAD OF THE GOVERNMENT LINK COMPANY WHERE THESE MILLION HAVE DISAPPEARED IS DIRECT CULPABLE IN THE COVER UP.

http://www.aljazeera.com/programmes/101east/2015/09/murder-malaysia-150908131221012.html

http://www.wsj.com/specialcoverage/malaysia-controversy

http://www.wsj.com/articles/malaysias-1mdb-the-secret-money-behind-the-wolf-of-wall-street-1459531987

http://www.asiasentinel.com/politics/murdered-malaysia-prosecutor-anthony-kevin-morais-najib-graft/

http://www.sarawakreport.org/2015/11/kevin-morais-drew-up-the-charge-sheet-against-najib-and-then-sent-it-to-sarawak-report-says-brother/

http://www.sarawakreport.org/2015/11/kevin-morais-drew-up-the-charge-sheet-against-najib-and-then-sent-it-to-sarawak-report-says-brother/

http://www.sarawakreport.org/2015/07/my-father-died-for-reporting-corruption-at-ambank-exclusive-interview/

MALAYSIANS ARE SUFFERING. THE ELITE CONTINUE TO VOICE THEIR SUPPORT TO THE PRIME MINISTER AND HELP COVER UP THE MISSING BILLIONS.