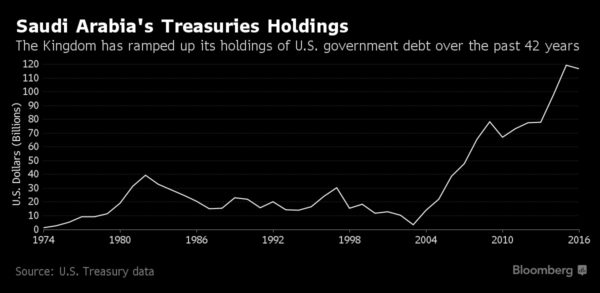

Many commentators describe it as one of the biggest mysteries in global finance, the amount of United States debt owned by the Kingdom of Saudi Arabia. For more than four decades, the two countries have refused to let transparency in their financial dealings prevail. They have remained in a secret partnership with each other on their finance, allowing speculation to take over.

However, the secret financial dealings between the two nations seem to have finally come to an end. The United States Treasury Department has made a surprise announcement that the oil-rich nation of Saudi Arabia has accumulated $116.8 billion of the country’s Treasuries, as of March 2016. The announcement was made on Monday 16th May.

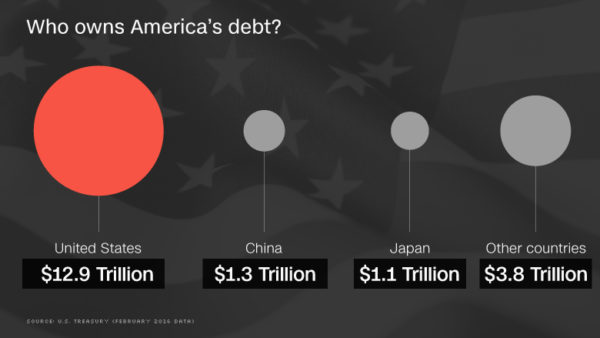

This stunning revelation, therefore, makes Saudi Arabia the 13th largest foreign holder of United States debt. The biggest holders of United States debt are China and Japan. Each country owned over $1 trillion. As of May 2016, the United States’ total national debt stands over $19 trillion.

Since the early 1970s, the United States has refused to specifically reveal how much Saudi Arabia has accumulated with its debt. It is said Saudi’s holdings of United States debt were added together with that of other oil exporting nations, including Venezuela and Iraq, making it difficult for one to know the exact holding figure by Saudi Arabia.

CNN reports that the current disclosure of the Saudi figure was through the initiative of Bloomberg News, based on a Freedom of Information Act request. Acting on the request, the Treasury Department disclosed precise holdings by specific countries that were previously grouped together, revealing the Saudi figure. It seemed many observers were interested in knowing the Saudi figure.

However, a Treasury official told CNNMoney that the disclosure was made following a review aimed at trying to provide more “comprehensive and transparent” data for the public’s right to know.

Apart from the Saudi figure, the new Treasury report also revealed that the Cayman Islands, a country of less than 60,000 people, owned $265 billion of United States Treasuries as of March 2016. The Cayman Islands does not have a corporate tax, encouraging multinational companies to store vast sums of money in tax avoidance.

Bermuda, another popular tax haven, is also holding $63 billion of the debt. CNN reveals that previously, both the Cayman Islands and Bermuda were lumped together in a group of Caribbean banking center nations like the oil exporting nations, which included Saudi Arabia.

Despite even the disclosure of the Saudi figure, some observers are still skeptical. This is because Saudi Arabia’s central bank is reported to have listed owning $587 billion of foreign reserves as of March 2016. Observers say that the central banks park the majority of their foreign reserves in the United States Treasuries.

Some observers believe that the disclosure of the Saudi figure did not come about only through the Freedom of Information Act request by Bloomberg News.

Tensions have been building between the United States and Saudi Arabia over the past months. An anonymous source in the Treasury Department revealed that Saudi Arabia recently threatened to sell off American assets if Congress passed a bill that would allow 9/11 victims to sue foreign governments. It is said the Saudis were serious about the threat, and were making preparation to sell off those assets.

The United States has realized the level of the threat, and therefore wants to begin to transparently deal with the Saudis. The threat has also left the Obama administration in confusion. Recently, President Obama admitted publicly that if Congress passes the bill that would allow 9/11 victims to sue foreign governments, he will veto it. Obama, therefore urged Congress not to pass such a bill.

You want to support Anonymous Independent & Investigative News? Please, follow us on Twitter: Follow @AnonymousNewsHQ

This article (After 40 Years of Secrecy, United States Admits Saudi Arabia Owns $117 Billion of Its Debt) is a free and open source. You have permission to republish this article under a Creative Commons license with attribution to the author and AnonHQ.com.