Between 2015 and 2016, an anonymous whistleblower leaked a whopping 11.5 million documents (some dating back to the 1970s) from the internal database of Panama-based Mossack Fonseca – the world’s fourth biggest offshore law firm – to a German newspaper Süddeutsche Zeitung.

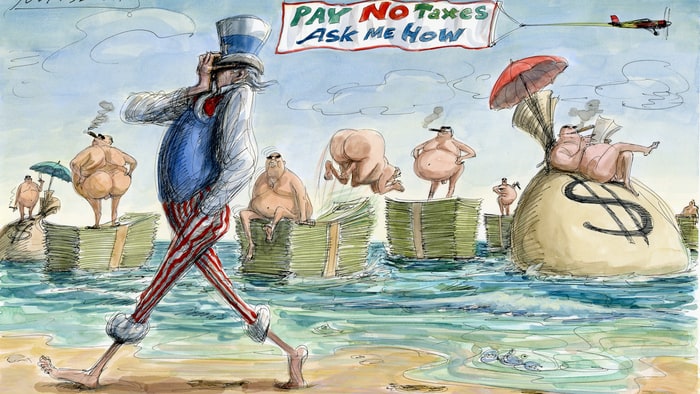

The documents, quickly dubbed the Panama Papers, revealed that a couple of Mossack Fonseca shell corporations were being used for fraud, tax evasion, and evading international sanctions. They also showed how criminals, the corrupt, and money launderers were exploiting secretive offshore tax havens; and that the big multinational companies (operating in both EU and non-EU countries) as well as 12 national leaders (including Russian president Vladimir Putin) were among 143 politicians taking advantage of tax loopholes.

The Panama Papers scandal, which exposed how the world’s rich and famous hide their wealth offshore, prompted the US government to act on regulatory reforms. These reforms were said to address the alleged attempts by foreigners to launder their proceeds of illegal activities through the United States (via, but not limited to, cash-only high-end real estate purchase).

In February 2016, a congressional bill was introduced (still pending) in the US House to stem the crime and drug trades, make tax policy fairer, promote transparency, and to tighten the noose around tax cheaters. The bill was intended to crack down on the crony capitalism and make it mandatory for the US companies to disclose their owners.

With Donald Trump’s win, it became doubtful the bill would ever see the light of the day. Trump (who has refused to release his tax returns) planned to make the US a massive fiscal haven for global companies that evade taxes in their home countries. Gabriel Zucman, a French economist, noted:

“Adieu to Ireland, Luxembourg and Bermuda. These tax havens are about to be made obsolete by Donald Trump’s America. Congressional Republicans want a border adjustment tax meaning that exports wouldn’t be taxed while imports would be. If this effort succeeds, the U.S. will siphon off the fiscal base of countries all over the world.

“It would become the biggest de-facto tax haven on the planet. It will be in the interest of multinationals to manipulate transfer prices — the prices different branches of one company charge each other for the goods and services they exchange — so as to artificially move profits back to the U.S.”

In November, American economist and Nobel Prize laureate Joseph Stiglitz urged Europe to fight tax havens that “pose a threat to global governance because they facilitate money laundering, corruption and other crimes, as well as unacceptably high levels of global wealth inequality.”

“It’s hard to be optimistic when your president is a tax avoider or even evader-in-chief. If we cannot convince our citizens that we can tamper globalization, there will be an anti-globalization action. Anyone who thinks globalization is a good thing must be willing to address its darker sides, of which tax secrecy is one.

“Countries and businesses that refuse to reform must be treated as the carriers of a dangerous disease. They should be cut off from the global markets.”

On its part, the EU vowed to draw up a blacklist of tax havens, which is expected to be finalized by September 2017, to fight tax evasion and money laundering.

In February 2017, the European Union sent letters to 92 countries, including the United States, warning they were being screened for tax-evasion practices and that they must be prepared to face EU sanctions if they fail to meet a range of criteria. The screening would look for transparency, preferential tax regimes, no or zero corporate rate tax, strength of ties with the EU, financial activity, and stability – with the US to find themselves blacklisted if found guilty.

Though the EU finance ministers recently defined the final criteria for the identification of tax havens, and agreed on a proposal to close tax loopholes that allow multinational companies operating in both EU and non-EU countries to avoid paying taxes, German politician and Member of the European Parliament Sven Giegold called the blacklisting an act of whitewashing. He did, however appreciate the agreement:

Though the EU finance ministers recently defined the final criteria for the identification of tax havens, and agreed on a proposal to close tax loopholes that allow multinational companies operating in both EU and non-EU countries to avoid paying taxes, German politician and Member of the European Parliament Sven Giegold called the blacklisting an act of whitewashing. He did, however appreciate the agreement:

“The criteria for the identification of tax havens are a bad joke: a country which allows profit shifting of companies and exempts these profits from taxation will not be considered a tax haven. Tax havens that attract companies without significant corporate taxes will not appear on the blacklist of the future EU.

“The agreement reached by the EU finance ministers on amendments to the anti-tax avoidance directive is a major step forward in the fight against tax avoidance. Europe is thus playing internationally a pioneering role in the fight against tax avoidance by large companies.”

Ahead of the European Parliament’s Panama Papers investigative committee’s 4-day visit to the US to probe money laundering, tax avoidance, and tax evasion issues, the European Parliament released a report which blamed the existing US laws (that permit beneficial owners of companies to remain anonymous) for attracting money flows from around the world.

Describing the United States as a growing haven for tax evasion and money laundering that tolerates highly secretive anonymous shell companies within its own borders, the report criticized the Trump administration for continuing to provide an array of secret and tax-free facilities for non-residents at federal and state levels.

This article (EU Fights Trump’s Plan to Make US the World’s Biggest Tax Haven for Money Launderers) is a free and open source. You have permission to republish this article under a Creative Commons license with attribution to the author and AnonHQ.com.

Supporting Anonymous’ Independent & Investigative News is important to us. Please, follow us on Twitter: Follow @AnonymousNewsHQ

Trump is a very smart man and a very good president. The EU has destroyed Europe and the Baltics with there open borders and Globalists One World Order agenda…. The people are scared and not happy… Americans better stand up for Trump…..