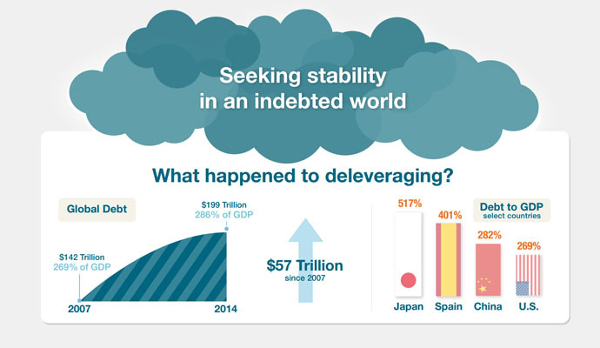

Since the financial crisis in 2008, global debt has increased by $57 trillion. By the end of 2014 the amount of world debt reached $199 trillion. Experts warn that additional steps and new approaches must be taken to avoid economic collapses around the world.

“After the 2008 financial crisis and the longest and deepest global recession since World War II, it was widely expected that the world’s economies would deleverage. It has not happened. Instead, debt continues to grow in nearly all countries, in both absolute terms and relative to GDP. This creates fresh risks in some countries and limits growth prospects in many,” according to new research carried out in 47 countries by consultants at McKinsey & Company, a multinational management consulting firm.

There are many who claim that the very possible threat of a global economic collapse is the most serious issue we face. In an interview with King World News, legendary Swiss investor, Marc Faber, was asked what the greatest danger facing the world is today. His reply:

“The greatest danger is central bankers—they’re going to bankrupt the world. That’s for sure. It’s only a question of when and how it will occur.”

The only countries that were able to cut their debt were Argentina, Romania, Egypt, Saudi Arabia, and Israel. Of those countries, who had the highest debt-to-GDP ratio increase (the ratio between a country’s government debt and its gross domestic product):

- Ireland’s debt-to-GDP ratio saw a record increase of 172 percent.

- Japan saw a 64 percent increase and remains the world’s highest at 500 percent.

- China’s debt has quadrupled since 2007—from $7.4 trillion to $28.2 trillion by mid-2014—and has reached a 282 percent debt-to-GDP ratio.

- The United States now stands at 269 percent.

Quite a few American companies could face bankruptcy in 2015, including the clothing company, Aeropostale Inc., who has experienced $77 million in profit losses and Sears Holdings Corp., who generated a negative operating cash flow of nearly $2 billion in 2014. Radio Shack has already filed for Chapter 11 bankruptcy.

Households across the world are going further into debt as well. According to reports, only five countries saw a slight decrease in debt amongst citizens—The United States, Ireland (ironically), the United Kingdom, Spain, and Germany. “In such developed countries as Australia, Canada, Denmark, Sweden and the Netherlands, as well as Malaysia, South Korea and Thailand, the debt exceeds the pre-crisis level.”

What we should be asking ourselves is, what happens when a nation goes bankrupt?

In 1999, Argentina’s President, Carlos Menem, took on a capitalist society without proper checks and balances. Businesses thrived at the expense of the people, and in a matter of one night, the wealthy fled the country taking over $40 billion with them, resulting in a run on the banks, and a collapse of the country’s national currency.

In desperation, people spent nights sleeping in front of automated teller machines in an effort to extract their money as soon as possible, and as a result the government froze all bank accounts for a year, allowing people to only withdraw an amount around $250 a week. By December of 2001, confrontations between the police and citizens were common.

“Power companies stop operating, police stop working, gas stations close, grocery stores run out of food, postal workers stop delivering mail, retirement checks stop coming, and banks close their doors with bankers fleeing the country, taking people’s life savings with them.”

It is believed by many that the next chapter in global unrest will soon begin. Are you prepared?

SOURCES:

Frey, Thomas. World Future Society. Jun 2, 2012. (http://www.wfs.org/blogs/thomas-frey/when-countries-go-bankrupt)

Higgs, Abby. Money Morning. Feb 10, 2015. (http://moneymorning.com/2015/02/10/the-five-next-companies-to-go-bankrupt-in-2015-after-radioshack-rshc/)

King, Eric. King World News. Feb 9, 2015. (http://kingworldnews.com/marc-faber-unveils-biggest-surprise-2015-greatest-danger-facing-world-today/)

- RT. Feb 6, 2015. (http://rt.com/business/229883-world-debt-sharp-increase/)

Who is the world owning money to? Mars? Jupiter? Seriously, there cant be a debt over limit, since its always 0 or over because of the fact that it started at 0 and went over, then down again. Just drop all the bills and the debts and world wont face anything of a crysis.

No one willing to agree to disagree and compromise. To much greed to realize how stupid this really is.

http://www.collective-evolution.com/2014/03/28/former-world-bank-senior-council-says-a-second-species-on-earh-controls-money-religion/

Page not found

Money is created out of nowhere by the system.

Capitalism is a system that works by creating debt in order to maintain growth.

The only difference to Socialism or Communism is that this kind of debt is not national but global and shared among all the countries that adopt the system.

Think in this way:

If all bank account owners on the world try to withdraw all the money from all their accounts, would there be enough money for all?

The answer is not. What would happen is that all banks would go bankrupt.

Im prepared to invest in some companies and wait for the end of the crash. same as 2009 😀 eheh!

Good. Excellent. Shut everything down. Burn all the money, restart currencies with different formats. Since the governments won’t cooperate with their people and nothing’s obviously gonna change it, and The working classes are trapped in financial slur, and every powerful tool on the fucking planet is aquired with money, hopefully doing a ‘master reset’ on the economy will detox the bullshit.

I used to work for a Bank of America in collections for small businesses credit card. It is easy to get small business credit cards but hard to pay it back. When economy is bad small business owners use credit to float by hoping the economy would change so they can pay the credit card off and make a profit. I did say hope but that isn’t most of cases some of the time so the small business is stuck with a 50,000 to 80,000 bill that they could never pay back. Sometimes they can’t pay the balance back because they have no means to. Other cases it’s greed they rack up the credit card and play games. That’s the same as a bank robber. But Bank of America I used to work for knew this so in return they hike up the interest rate making it more difficult for some business owners to pay back the debt so all in reality the blame is some of the lenders for spiking up the interest rate in hopes to gain a profit. Funny Bank of America says it wants to help thr customer but they put regulation ontop of regulation making offering customers a resolution ir helping the customer difficult. But Bank of America always has an excuse they blame the OCC for making to many regulations for programs helping Bank of America customers.

I used to work for a Bank of America in collections for small businesses credit card. It is easy to get small business credit cards but hard to pay it back. When economy is bad small business owners use credit to float by hoping the economy would change so they can pay the credit card off and make a profit. I did say hope but that isn’t most of cases some of the time so the small business is stuck with a 50,000 to 80,000 bill that they could never pay back. Sometimes they can’t pay the balance back because they have no means to. Other cases it’s greed they rack up the credit card and play games. That’s the same as a bank robber. But Bank of America I used to work for knew this so in return they hike up the interest rate making it more difficult for some business owners to pay back the debt so all in reality the blame is some of the lenders for spiking up the interest rate in hopes to gain a profit. Funny Bank of America says it wants to help thr customer but they put regulations ontop of regulation making offering customers a resolution ir helping the customer difficult. But Bank of America always has an excuse they blame the OCC for making to many regulations for programs helping Bank of America customers.

I knew about this since I was about 12 and I’m 20 now. Money is the worst and most evil thing on this planet. I one one day the whole world would become bankrupt… It was only a matter of time. When we overthrow our system we need to work on getting rid of money completely.

Exactly JP Morgan have $62 Trn Derivative liability, Deutsche Bank have $74 Trn. What would happen if they had to unwind this position, mayhem.

All the banging on about other countries problems is evading the question of the elephant in the kitchen.

So what is the solution? Does anybody knowledgeable about finances have any idea? Is the problem the bankers,””””

GALVANOPROJECT GLOBAL STOCK EXCHANGE

Ultimo aggiornamento: 2 secondi fa

GALVANOPROJECT GLOBAL STOCK EXCHANGE :

MERCATO UNICO GLOBALE : NON ESISTERA’ PIU’ UN MERCATO UNICO GLOBALE ILLEGALE, POICHE’ TUTTO VERRA’ LEGALIZZATO.

https://www.facebook.com/Galvanoproject/info

http://www.greenreport.it/news/economia-ecologica/nasa-la-civilta-umana-e-vicina-al-collasso-economico-ed-ecologico/

https://www.facebook.com/media/set/?set=a.838736706171991.1073741848.838736079505387&type=3

GALVANOPROJECT GLOBAL STOCK EXCHANGE

GALVANOPROJECT GLOBAL STOCK EXCHANGE :

MERCATO UNICO GLOBALE : NON ESISTERA’ PIU’ UN MERCATO UNICO GLOBALE ILLEGALE, POICHE’ TUTTO VERRA’ LEGALIZZATO.

https://www.facebook.com/Galvanoproject/info

http://www.greenreport.it/news/economia-ecologica/nasa-la-civilta-umana-e-vicina-al-collasso-economico-ed-ecologico/

https://www.facebook.com/media/set/?set=a.838736706171991.1073741848.838736079505387&type=3

The financial black hole that is the US derivatives market is $600 trillion ~ if that ever crashes, it will be a global economic meltdown … http://www.usdebtclock.org