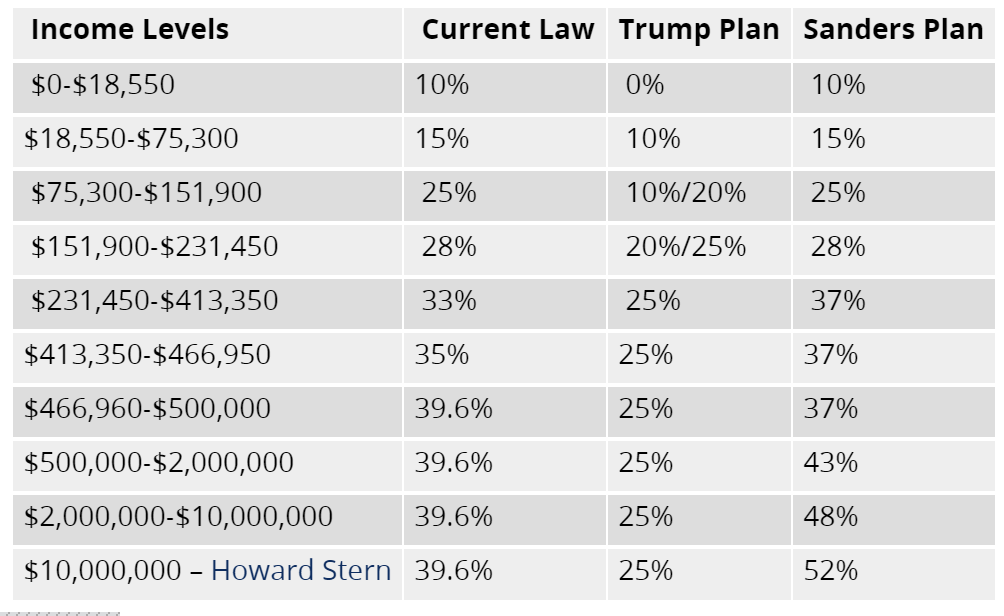

Before the usual crowd starts screaming about “socialism” or something like that, one needs to calmly examine the chart provided by Forbes below. (Note: the tax-brackets are based on married couples who jointly file their taxes.)

Sanders’ plan has taxes remain exactly the same for couples earning less than $151,900 a year, or 6,329.16 dollars per month for an individual.

In comparison, Trump’s plan would have taxes eliminated for individuals earning less than $773 a month, while reducing taxes all around. Those who earn more than $9,643 a month stand to gain the most, as the tax rate remains stagnant at 25% all the way to the very highest earners.

Under Trump’s plan, a person earning $5,000,000 a year or more would save $730,000 or more per year in taxes while a person earning $9,275 a year or less stands to gain a maximum of $927.5 a year- or, a single person who earns $5,000,000 a year would save the equivalent of 787 of his fellows at the lowest tax bracket.

Not a bad deal for the super rich, though everyone pays less for infrastructure that the super rich typically do not require (public schools, etc) and the government waste that only benefits corporations. Eliminating taxes on the lowest bracket might be a good idea though.

Sanders’ proposed highest rate for individual income tops out at 52%, 12.4% higher than previously, and the highest since the 1980s when taxes maxed out at 70% under Jimmy Carter (interestingly, .

This tax on income would not affect capital gains and dividends (the preferred means of income earning for the very rich)… if it were not Sanders’ plan to also get rid of this preferential treatment once and for all. He will have this sort of income classified together with earned income and thus be taxed at the same rate, and not maxed at 23.8% as it is currently.

These changes are estimated to raise 235 billion dollars in tax revenue annually.

Sources: Forbes

This Article (Bernie Sanders’ Tax Plan Sends US Super-Rich Into Panic Mode) is free and open source. You have permission to republish this article under a Creative Commons license with attribution to the author(CoNN) and AnonHQ.com.

That’s extraordinary; in New Zealand the tax rate for anyone earning over $70,000 NZD (approx $45,000 USD) is 33%. In Australia, every dollar earned over $180,000 (approx $125,000 U.S) is taxed at 45 cents in the dollar. Why is the U.S. tax rate so low?!

your looking at it wrong, u should be asking why your taxes are so high….

It pays for our education, health and infrastructure.

The US is also heavily in debt, far more so than Australia

lol mate.. None of those countries are in “debt” they make trillions per year from other business practices like prisons for profit and so on

(selling weapons and arms to other countries)

Americas real budget(not debt) probably well in the tens of trillions.

http://www.usdebtclock.org/

Lol, and silence from Bret.

Obama trillion dollars vacations and lending other countries money that we do not get back!

Uh… Yeah, no.

This just in: Taxes pay for all sorts of necessary shit.

Up to and including the infrastructure that you’re able to spew this drivel on.

They don’t have free diploma level study like us. You can go work anywhere in the world and you make conscientious decisions about cohabitation and preservation.

Louloudeschanel, because the money men have taken over the country, and most politicians are servants to the dollar, not the population.

That’s just federal income tax. There is state income tax, sales tax, property tax.

Because they do it the “elite way” oeewaaa! Debt is their money machine. And they’re really professionals in printing federal reserves, in a sientific miracle way, they create money out of thin air?!! Whoop $$$$ there it is! And whoop…they can vanishe $ 9 bln! Lord, they must have miracle teachers. And always comming up with the best solutions….ping! Got it! We shut down the couvernment offices! And spread the fear of terrorism…man..it all doesn’t make any sense…It’s time they stick their pointing finger and yes…their nose up their own ass!! Just leave the world alone and mind their own delusional business. Time to change their dipers…..

Just kidding 😉

Own up, don’t say, “just kidding” at the end with a wink. Tell the world what you really think! I agreed with you until you tried to be cute. Be honest with it, though. American forces bailed out the Aussies when Japan got involved. The first part of the plan was to obliterate the British and their bastard rejects. So the more you generalize the U.S., the more you should be ready to own your failures as well. You were set to be H-bombed with Britain and the States on principle, given that U.S. tycoons were funding the war on both sides, and backed by British leaders. You wouldn’t be alive now if it weren’t for the fools that enlisted after Pearl Harbor. So, tell the story straight, or keep your wannabe cute mouth shut. That your country has made great strides in justice since the war doesn’t give you right to demean and slander the good men and women that have been fighting for justice and freedom in and from the U.S. Keep your accusations locked where they belong: the %1.

The US also has state income taxes – up to 13%

Because the uber wealthy paid our coin operated Congress to lower their rates.

In my opinion, thats still really generous towards the richer part of the population. Lets look at the taxation system that I’m used to in the Netherlands:

Income level (annual) Taxation

€ 0 t/m € 19.922 36,55%

€ 19.923 t/m € 33.715 40,15%

€ 33.716 t/m € 66.421 40,15%

€ 66.422 or more 52,00%

Now that are high tax rates, and still we’re rated as one of the happiest populations in the world. Yes a big chunk of our wages goes to the government, but it gains us stability and a good social system. America has a long way to go in my opinion.

hear hear

Its not the tax they dont pay its the money and all the profits they take abroad in offshore banks or tax heavens! And the goverment and financial police is so corupt that they let that pass all the time laundering money theft and stuff like that. They imprision small time criminals for theft of a dvd a sound system or a tv and they let these multi bilionare douchebags to get away with bilions and bilions of dollars/euros slip into safety. When will the working class man wake up stop voting for these criminals and fight for its rights we are slaves in our own countries not to other invading countries kings or dictators but to our own financial systems that is robing us legaly!

our system makes billions for corps . we live and die in the streets . the police, prisons and medical industry makes lots extra because we do not have a normal home life in America anymore.

funny thing is Money is an invention. it is not finite. we can make up any rules we want. with 3% growth in the world population, that set inflation at 3% from standard demand growth. rules that we live and die by to keep the tally in tact. end this monopoly game and build an economy based on the needs of a people to thrive!(not just survive)

But the Netherlands is gonna be overrun by Muslims if you guys dont start growing some balls real soon.

The rich should be glad they didn’t bring back the tax rates of 1944 under Franklin D. Roosevelt. 94% for the richest tax bracket (set at $200,000 a year) and 23% at the poorest tax bracket!

us should take the german tax model into consideration.

0 – 8000 income -> tax free

>8000 – 52k -> rising percentages from 0 to 42%

>52k -> 42%

America would go bankrupt under Trump’s plan, plus he thinks people are paid way too high so with slashing the minimum wage the economy would go in the toilet with in a year or so. The police state would be in over drive picking up anyone that looks Latino or Arab. Once they are gone then he will be coming for who ever else he doesn’t like. Before his 4 years would be up we would be living like Mad Max.

presidents have little actual power. Lawmakers do the things you describe.

I know you want to be anonymous and all that, but my last name is Conn, too! Who ARE you?! 🙂

Trump is running for himself. So he pays less taxes.

This article is utterly useless. Until one sees the plans of each of the politicians for deductions as usual or elimination, we have no idea what the actual effective tax rates will be. GE has paid zero taxes on over 25 billion in revenue for the past many years due to deductions and international money movements, even though the prima facie tax rate is very high for US corporations. That’s how the politicians can speak out of both sides of their mouths. They say one thing about rates, but they have so far done nothing but add to the immensely complicated tax code with more and more special deductions that sometimes even name specific companies that can use the deduction. The level of fraud here is immense. If Anonymous wishes to become known for insightful and honest discussion, it would be best to leave misleading fluff pieces like this in the trashcan.

They don’t use public infrastructure? Ummm roads??? Which they mostly damage, with their big ass semis. How about the fact they use our PUBLIC officials, they use them an awful lot too.

Seems to me it’s all about the lifeless

Despicable lower class majority.that demand the quasi-educated robin hood’s

Come to their rescue.Despicable totally despicable.they should all be

Deported to the dakotas.