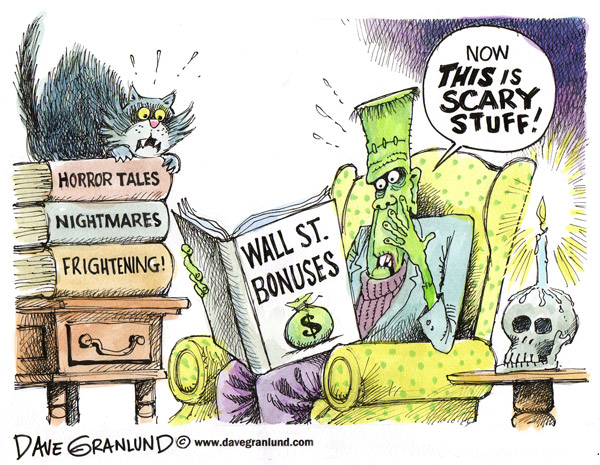

New rules proposed by federal regulators could force high-ranking executives who work at the largest Wall Street institutions to wait four years before they can collect all of their bonuses, and even after collection they could be forced to return the ill-gotten loot in the event that they are found to have taken inappropriate risks, or acted in a manner that affected their firms legally.

Investment advisory firms, banks, credit unions, Fannie Mae and Freddie Mac will be covered under the possible new rules.

The National Credit Union Administration (NCUA) released the rules for public comment, and noted that the executives who are employed at institutions with a value higher than 250 billion dollars have to wait four years before collecting 60% of their bonuses. Executives at firms valued between 59 abd 250 billion dollars would have to wait three years before they are able to collect 50% of their bonuses.

The new regulations are aimed at addressing one of the key causes of the last financial crisis: executives being incentivised to bet on riskier assets that seem to have better returns; winning larger bonuses on the upside and suffering no repercussions on the downside.

From the NCUA’s draft copy of the new rules:

“There is evidence that flawed incentive-based compensation practices in the financial industry were one of many factors contributing to the financial crisis.”

“Some compensation arrangements rewarded employees — including non-executive personnel like traders with large position limits, underwriters, and loan officers — for increasing an institution’s revenue or short-term profit without sufficient recognition of the risks the employees’ activities posed to the institutions, and therefore potentially to the broader financial system.”

“Significant losses caused by actions of individual traders or trading groups occurred at some of the largest financial institutions during and after the financial crisis.”

Bloomberg News notes that the very fundamental purpose of a financial firm is to take risks; disincentivising risky behavior, while not incentivising it overly is a tricky balancing act:

“Regulators also have had to wrestle with the concept of applying rules meant to curtail risk to an industry that is based on taking risks.”

Of course, there’s a difference between taking a risk… taking too much risk… and outright fraud. While imposing fines and withdrawing bonuses is an improvement on incentivising fraudulent/ risky behavior, it needs to be said that there are better methods for keeping execs on the straight and narrow. Don’t act so surprised that execs are incentivised to commit crimes when the most profitable of crimes go unpunished.

The Wall Street Journal notes that the spotlight on the finance industry has only led the “talented” (and possibly the “criminally liable”) to jump from that sinking ship and into companies where their precious bonuses remain protected.

“Already, the industry says it has seen people leave more traditional banking jobs for areas where compensation has gone untouched, such as hedge funds and startups, including in Silicon Valley,” the WSJ said. Isn’t that good news though?

Sources: NPR, Bloomberg News, BBR

This article ( Tougher Rules on Wall Street Bonuses Proposed by Federal Regulators) is a free and open source. You have permission to republish this article under a Creative Commons license with attribution to the author(CoNN) and AnonHQ.com.