When Saudi Arabia decided against cutting production targets in 2014, letting the price fall from around $100 to less than $50, the oil producing country wanted to throw weaker, less efficient OPEC and non-OPEC oil-producers out of the market by slashing their profit margins. But, the move backfired. (Moody’s estimates crude oil prices to average $33 per barrel in 2016 as oil cartel OPEC and many non-OPEC oil producers continue to produce without restraint as they battle for market share.)

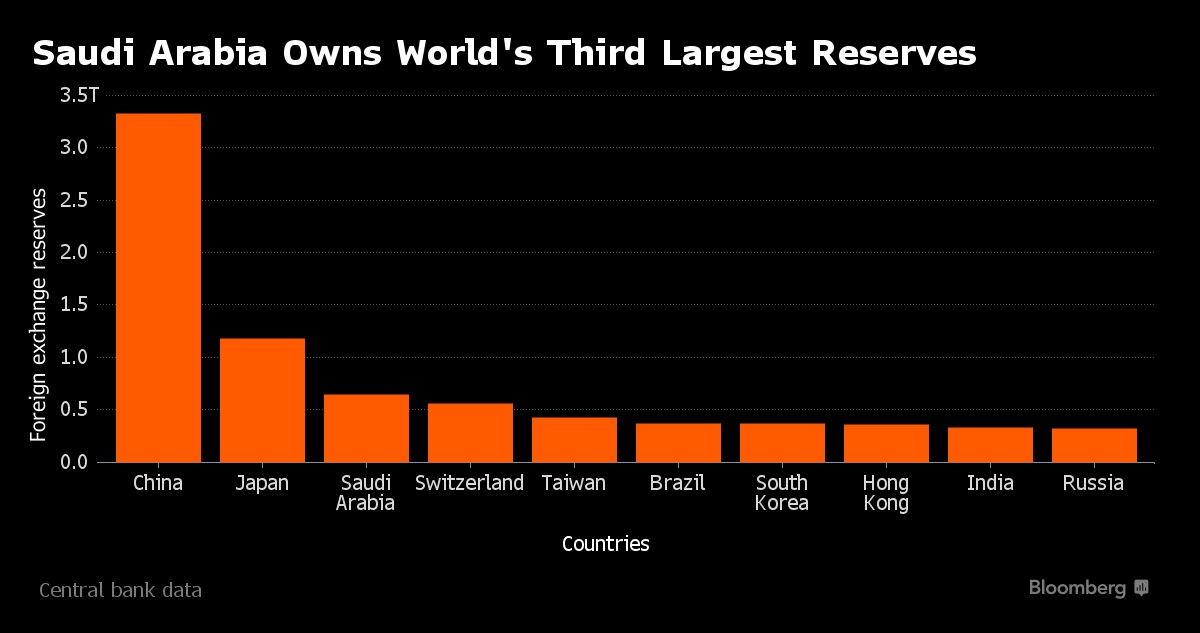

Saudi Arabia, which generates 90% of its income from oil, currently has $654.5 billion in foreign reserves, but the cash is disappearing quickly. In 2015 alone, Saudi Arabia burned through about $100 billion of foreign-exchange reserves to plug its biggest budget shortfall in a quarter-century. Last year, Saudi Arabia bypassed Russia to take over the world’s third spot in military spending, with a defense budget of $80.8 billion. In its World Economic and Financial Surveys, the International Monetary Fund predicted that the country could be bankrupt within five years – by 2020.

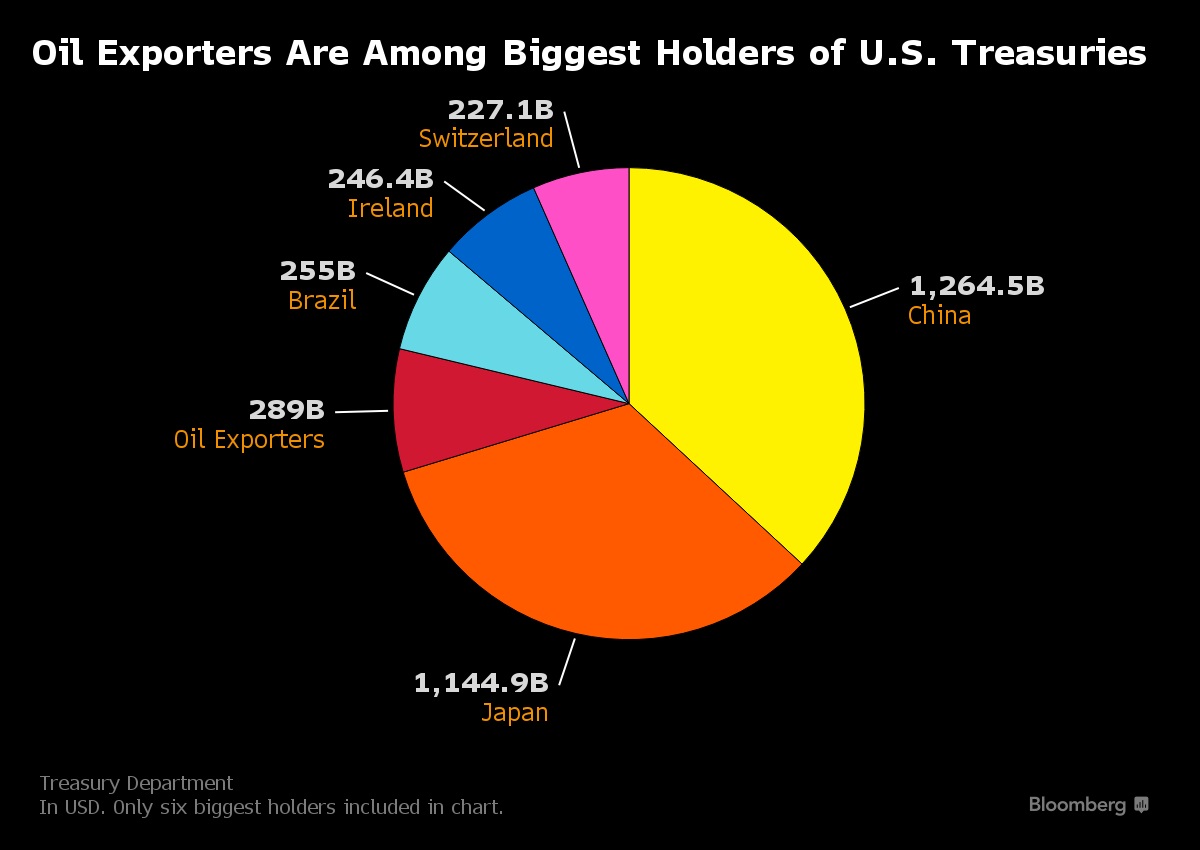

The failure of its oil price gambit and subsequent signs of strain have brought the age-old question to the fore again – Just how much of America’s debt does Saudi Arabia own? Bloomberg writes of Saudi Arabia’s US Treasury holdings:

“It’s a secret of the vast US Treasury market, a holdover from an age of oil shortages and mighty petrodollars. As a matter of policy, the Treasury has never disclosed the holdings of Saudi Arabia, long a key ally in the volatile Middle East, and instead groups it with 14 other mostly OPEC nations including Kuwait, the United Arab Emirates and Nigeria.”

Though the Saudi debt secret, which the US Treasury had kept since the 1973 oil shock following the Arab embargo “because the US needed their oil hence the Treasury didn’t want to offend OPEC”, is not yet out in the open, it hasn’t kept the Treasury from disclosing figures for all other countries.

Now that Saudi Arabia and oil both are sliding, why can’t the US Treasury disclose Saudi Arabia’s outsize position in the world’s largest and most important bond market? Only Saudi Arabian Monetary Agency or SAMA, Ministry of Finance, a handful of Treasury officials and some bureaucrats at the Federal Reserve have a clear picture of Saudi Arabia’s US debt holdings and whether they’re rising or falling. But the data would not be shared with the world, at least anytime soon. How else will America maintain its strategic relationship with the Saudi royal family and access the kingdom’s deep oil reserves?

Despite political and economic constraints, the information may not be kept secret for a long time.

America is one of the world’s largest oil producers, and close to 40% of US oil needs are met at home. Domestic oil boom and gas production has helped to increase America’s energy security and allow the country to become less reliant on Saudi Arabia.

Has the United States of America been sold to Saudi Arabia to settle debt of $ trillions? World power to ‘gun for hire” under Obama?

— Bad Imitation John (@J0HNMcTERNAN) November 17, 2015

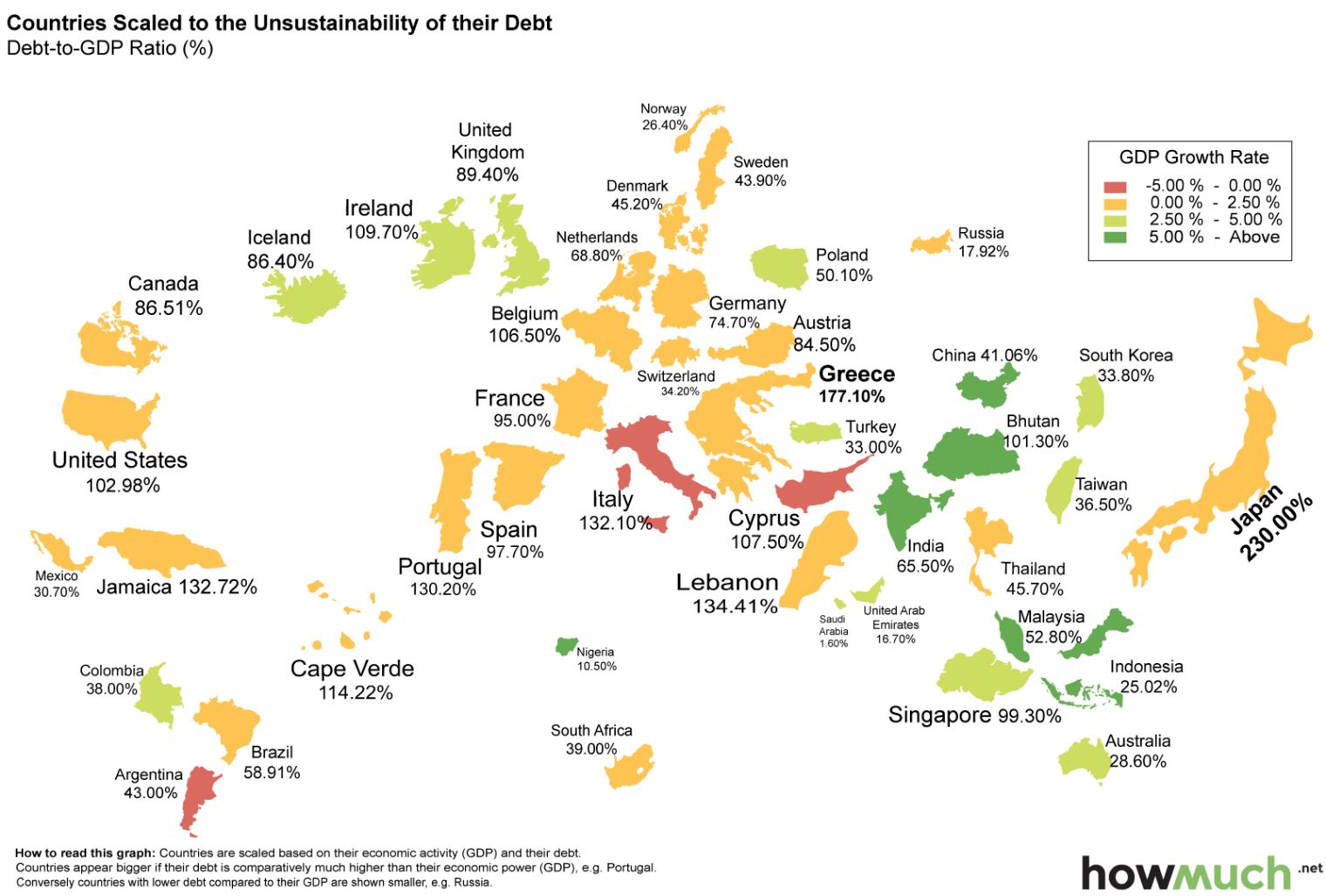

Debt-to-GDP Ratio (%): 1. Saudi Arabia 1.6% 2. Russia 17.92% 3. China 41.06% 4. India 65.50% 5. America 102.98%. http://t.co/LLuC1boZmM

— Ahmed Xahir (@OscarXahir) October 12, 2015

Since the US-Saudi relationship has always been about self-interest, not values, Saudis have lost trust in the United States in recent years, particularly as the Iran nuclear deal was clinched. Recent media reports claim Riyadh has refused the Pentagon’s offer of combat ships to modernize its fleet in the Persian Gulf.

Whatever may be the implications of the current crisis, some analysts speculate Saudi Arabia may actually be trying to hold onto its Treasuries as part of a strategy to bulk up on dollar assets amid the deepening turmoil in global financial markets.

According to Bloomberg, holding dollars makes sense as a hedge against the plummeting price of oil, which is priced in the US dollar. “You need dollars if you’re an oil producer, you want to make sure you have dollars on your balance sheet,” said Sebastien Galy, Deutsche Bank’s director of foreign-exchange strategy, who suggests SAMA could be raising cash by liquidating riskier investments such as stocks, real estate and private equity.

In February and March 2015, Saudi Arabia, the world’s largest oil exporter saw net foreign assets drop by more than $30 billion, the biggest two-month drop on record. Since the Kingdom holds one of the world’s largest reserve caches, these sales put downward pressure on the US dollar and upward pressure on Treasury bond rates. Was the move intentional?

The Bloomberg analysis leaves you with more questions than answers.

If Saudis drawdown all of their reserves, who would support the US Treasury Department? What if the tide turns for crude and if relations between Washington and Riyadh hit the skids over Iran, who will monetize the US? Will the US end the legacy policy of keeping Saudi Arabia’s US Treasury holdings shrouded in secrecy or continue to pacify the royals?

Why #America Allows #SaudiArabia to Get Away with Blatant #HumanRights Abuses https://t.co/LRqSPD6c5Z #Saudi pic.twitter.com/gicnEImdHI

— The Anti Media (@TheAntiMedia1) January 21, 2016

This Article (Here’s Why Saudi Arabia’s Secret US Treasury Holdings Is A Hot Topic, AND Why It Matters) is free and open source. You have permission to republish this article under a Creative Commons license with attribution to the author and AnonHQ.com.

Wouldn’t we have to worry more about China or Japan? It’s been know for over 30 years that WW III will start in the Middle east so shouldn’t we be aligning ourselves with the real big boys? Sooo,when do we by oil stocks? I’m thinking tonight..