(True Activist) Because cryptocurrencies are a threat to the banking elite, they are now threatening to close accounts if customers link them to Coinbase.

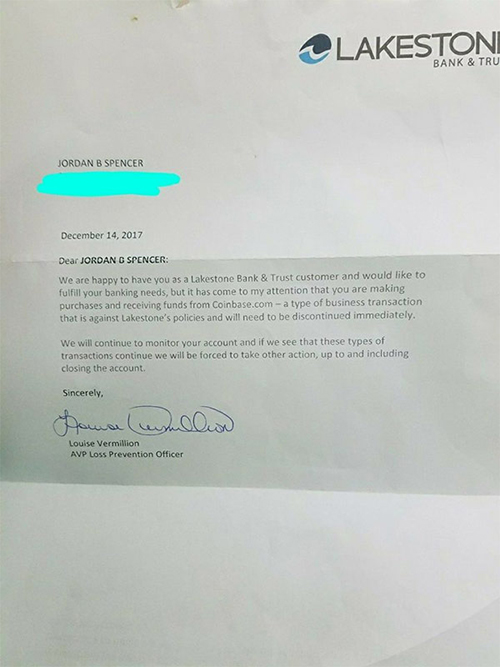

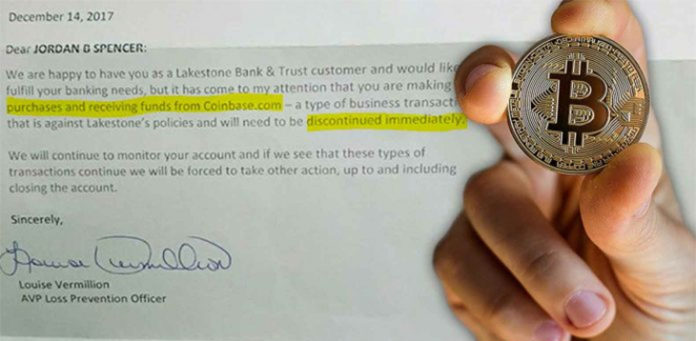

Cryptocurrency user Jordan Spencer recently received a letter from his bank warning him that his account would be closed if he continued to buy and sell cryptocurrency through the popular website and app Coinbase. The bank, Lakestone Bank and Trust also ominously threatened to keep an eye on his account to make sure that he obeyed.

Spencer posted the letter in a Facebook group for Ethereum traders to warn others about possible penalties or sanctions from banks.

“We are happy to have you as a Lakestone Bank and Trust customer and would like to fulfill your banking needs, but it has come to my attention that you are making purchases and receiving funds from Coinbase.com – A type of business transaction that is against Lakestone’s policies and will need to be discontinued immediately. We will continue to monitor your account and if we see that these types of transactions continue we will be forced to take other action, up to and including closing the account.”

It was reported this week that daily cryptocurrency markets are now doing the same volume as the New York Stock Exchange.

Last week, the SEC issued a statement warning investors about cryptocurrencies not being regulated by governments. The statement is interesting considering that the SEC has allowed, if not assisted, in the many financial scams that have left so many people destitute.

“Speaking broadly, cryptocurrencies purport to be items of inherent value (similar, for instance, to cash or gold) that are designed to enable purchases, sales, and other financial transactions. They are intended to provide many of the same functions as long-established currencies such as the U.S. dollar, euro or Japanese yen but do not have the backing of a government or other body. Other often-touted features of cryptocurrencies include personal anonymity and the absence of government regulation or oversight. Critics of cryptocurrencies note that these features may facilitate illicit trading and financial transactions and that some of the purported beneficial features may not prove to be available in practice,” the statement said.

Many cryptocurrency traders are fearing that more restrictions and regulations from governments are likely on their way.

If these sort of crackdowns from banks aren’t resisted by customers, we can expect them to increase. The centralization of power and control of currency is what gives the banking elite their power—cryptocurrency is a threat to that power as its very nature is based on decentralization.

As we reported earlier this week, the idea of cryptocurrency has actually been popular among crypto-anarchists and privacy experts for decades, and was predicted in Timothy May’s 1994 manifesto “The Cyphernomicon.” In the book, May prophesized about “sophisticated financial alternatives to the dollar, various instruments, futures, forward contracts, etc.”

Cryptocurrency is providing this financial alternative. Banks can either respect the wants and needs of their customers through facilitating a mutually beneficial relationship with those who wish to deal in both US dollars and crypto—or, they can die a slow economic death as cryptocurrency makes them obsolete.

Lakestone Bank and Trust appears to have made their decision.

GET YOUR BITCOIN NOW: https://www.coinbase.com