Written by: | WTF News |

The Russian currency crashed to new lows Tuesday, falling as much as 20 percent against the dollar during the day’s trading.

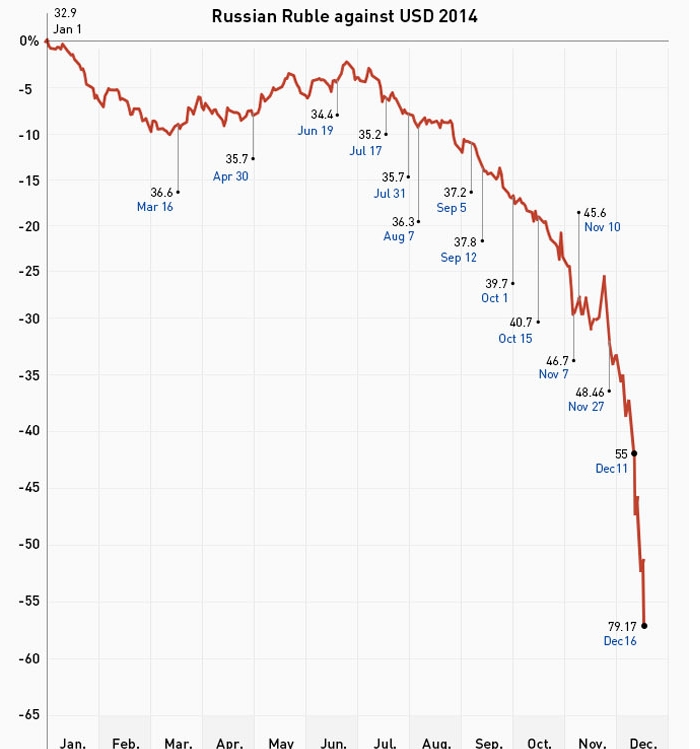

The ruble has been sliding throughout 2014, and has picked up speed during recent weeks with the additional pressure from the even faster paced crash of oil prices. The ruble began trading in 2014 at about 33 rubles to the US dollar, sliding to about 48 per dollar at the Thanksgiving holiday break.

The ruble’s decline has been met with counter-measures from Russia’s central bank, though the currency weakened into the 50′s and the low 60′s in the two weeks of trading until this week.

Monday, in the shock move of the day, Russian officials announced a surprise interest rate hike raising the country’s main rate from 10.5% to 17%, to slow the currency’s fall. Markets would ignore that in less than a day and continue to punish the ruble, at one point trading at about 80 rubles to the dollar and 100 to the euro. The volatile swings forced brokers around the world to react in extreme ways, some by widening spreads to ridiculous margins as seen in the picture. The confusion led to brokers eventually halting trades involving the ruble.

Bloomberg

FXCM Inc. (FXCM), the third-largest currency broker for retail clients, will stop offering the ruble versus the dollar and begin closing its customers’ trades. Alpari UK Ltd. stopped clients from taking new positions, while Saxo Bank A/S and Gain Capital Holdings Inc.’s Forex.com said they planned to demand a higher deposit from clients to deal in the currency.“Most Western banks have stopped pricing USD/RUB,” Jaclyn Klein, a spokeswoman for New York-based FXCM, said in an e-mailed statement. “FXCM can no longer offer this instrument to our clients and will begin closing any existing client trades in USD/RUB” from midday New York time, she wrote.

While the Bank for International Settlements estimates that retail trading only accounts for 3.5 percent of the $5.3 trillion-a-day foreign-exchange market, the moves highlight the disruptive nature of price swings in the ruble. The currency plunged as much as 20 percent against the dollar today, its biggest drop since at least 2003, after an increase in interest rates by the Bank of Russia failed to halt a selloff.

The ruble tumbled to 80.10 per dollar, a record low, before trading 6.1 percent weaker at 68.381 at 5:04 p.m. London time.

Russian equities had been suffering before this week and like the ruble, took huge losses on Tuesday.

RT.com

The Russian stock market also went haywire, dropping more than 15 percent as of 2:30pm Moscow time, after it dropped 11 percent the day before. Sberbank, the country’s largest lender, lost 17.77 percent, and VTB, the second biggest bank, fell by 14.29 percent. State-owned oil and gas companies Gazprom, Rosneft, and Surgut also saw shares plummet.The emergency interest rate hike to 17 percent has failed to halt the ruble’s landslide tumble against hard currencies. The rate increase only calmed the ruble temporarily.

It has accelerated its descent in November and December along with falling oil prices. Investors have been pulling capital out of Russia over geopolitics since earlier this year, and sanctions levied by the US and EU have essentially cut Russia off from Western lending.

Most analysts agree that Russia will enter recession in the first quarter of 2015, including the Economy Minister Aleksey Ulyukaev, and the Central Bank.

Welcome to World War 3