As the White House saga continues to dominate headlines, President Donald Trump is truly proving that he doesn’t represent the interests of ordinary Americans, as he had claimed during the race to the presidency in 2016.

Trump has huge investments in recreation, real estate, sports and entertainment. Trump’s business ventures and investments are managed by the Trump Organization — a family empire. Part of Trump’s fortune is from inheritance. As of May 2016, Trump has a net worth of $4.5 billion.

During the presidential campaign, many called on the then business magnate, now the boss of America, to release his tax returns. ABC News even alleged that Trump is involved in a massive tax fraud, explaining his reluctance to release his returns.

In a news article, titled “The Only Time Donald Trump Undersells: Tax Time,” the outlet chronicled how Trump has duped the country he is now leading, by blatantly undervaluing his properties in order to cut his tax bill. When the ABC contacted the Trump Organization for an analysis of the tax decisions implicating the family empire, officials declined to provide any information. Through to today, Trump has not yet responded to this scandalous allegation.

When the debate about his tax returns intensified, Trump said he was unable to release them due to what he described as a long-running audit. Observers treated this statement with a pinch of salt.

Of course, observers were right. Recently, Trump’s secretary of the treasury, Steven Mnuchin told reporters that the president “has no intention” of releasing his tax returns to the public. This tells us that Trump is hiding something incriminating on his tax returns, keeping the details from the public scrutiny; with critics saying he is likely a tax criminal.

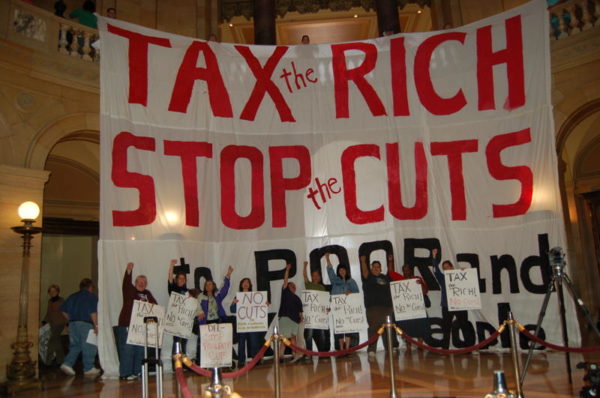

However, as Trump has refused to release his returns to clear his name, he is moving to implement a tax regime that observers describe as making the 1%, including Trump, richer. According to observers, if this Trump tax is passed, it would be the largest overhaul of the United States’ tax system since the Reagan era.

The administration has unveiled what it called the biggest tax cuts “in [the] history” of the country. Trump and his team claim the new tax system will simplify the country’s existing tax system. The new proposal would see a slash in taxes for businesses large and small, including Trump’s own numerous businesses scattered across the nation. It would also eliminate inheritance taxes.

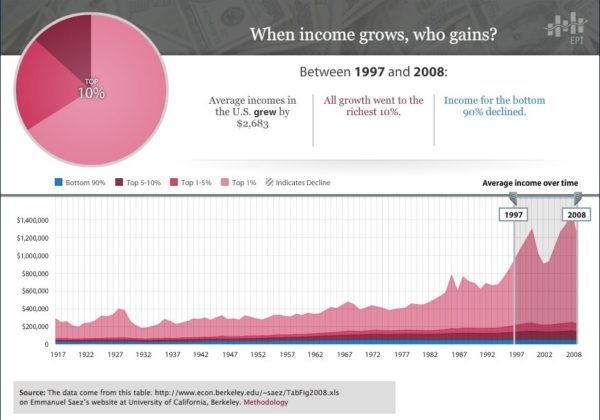

The new Trump tax system would also cut the United States’ individual income tax brackets from seven to three (10%, 25% and 35%), slashing the country’s corporate tax rates from 35% to 15%. This of course is nothing but a huge tax cut for the 1%.

What is more ludicrous about this tax proposal is that apart from cutting corporate taxes, the proposal will also cut what is known as the Alternative Minimum Tax (AMT). The AMT is designed to stop the super-rich from taking tax deductions to the point they avoid paying anything. In fact, in one leaked document, it was revealed that Trump was forced to pay up to $31 million in 2005 thanks to the AMT. This means if the AMT had not been implemented, Trump would have pocketed this huge sum of money. Is it any wonder why Trump is proposing to exterminate the AMT?

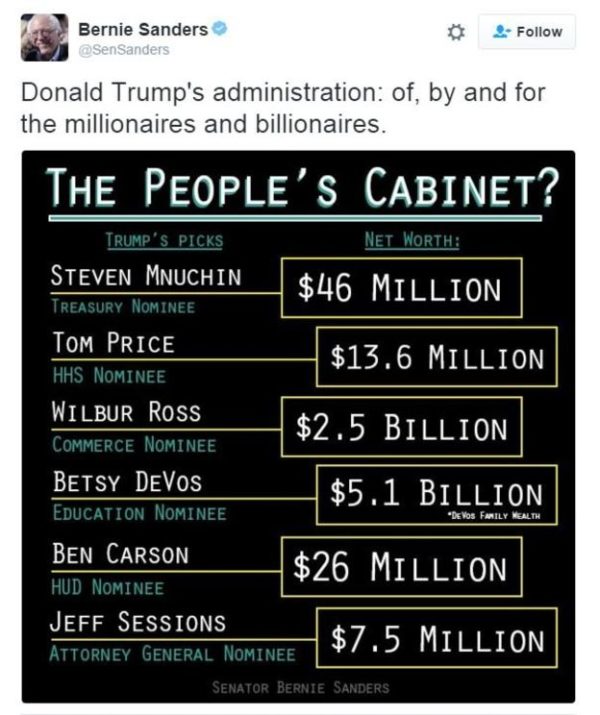

The Guardian reports that the new tax proposal would not benefit Trump alone. It would also benefit many of his cabinet members. Trump’s cabinet is the richest in American history and includes several billionaires.

Trump and his team have defended this proposal with the old argument that the rich should not be burdened with taxes in order to allow them to create more jobs for the populace.

“We have a once-in-a-generation opportunity to do something really big. This is about growing the economy, creating jobs,” said Gary Cohn, chief economic adviser to Trump.

But of course, this argument has been proven to be flawed over the years. Reducing taxes for the rich will not create jobs. This is simply because it is not the rich alone who creates employment.

In 2013, businessman and co-founder of Business Insider, Henry Blodget summed up this argument: “Yes, we can create jobs temporarily, by starting companies and funding losses for a while. And, yes, we are a necessary part of the economy’s job-creation engine. But to suggest that we alone are responsible for the jobs that sustain the other 300 million Americans is the height of self-importance and delusion.”

Currently, the gross U.S. federal government debt is estimated to be $20.1 trillion. In 2016 when Trump was on the campaigning trail, the debt was $19 trillion. Trump pledged then to cut the debts “big-league” and “very quickly” once elected.

According to the nonpartisan pressure group Americans for Tax Fairness, Trump’s corporate cut alone would add up to $2.4 trillion to the national debt. The group’s director, Frank Clemente called the new Trump proposal a “reckless” plan “for massive tax giveaways to corporations, the wealthy, and his own family” that would only add to the national debt.

“So, how would Trump’s White House make up the shortfall? By drastic cuts to essential services and lowering the standard of living for regular American families. Unacceptable. The White House line that ‘tax cuts will pay for themselves’ is a lie that has been debunked repeatedly, including by the conservative Tax Foundation. We will fight this tax plan tooth and nail, and we’ll be joined by Americans of all political stripes in doing so,” he said.

This article (Trump Taxes Proposal: Make the Rich Richer, Cut Corporate Tax by 15%, Eliminate Inheritance Tax) is a free and open source. You have permission to republish this article under a Creative Commons license with attribution to the author and AnonHQ.com.

Supporting Anonymous’ Independent & Investigative News is important to us. Please, follow us on Twitter: Follow @AnonymousNewsHQ